Reviewing competitor ads is an essential part of ad text creation or QA for any marketer.

And after locating the ads, it is key to have a systematic approach to analyzing them.

For paid search, this has historically been especially time-consuming.

It has been necessary to use third-party tools – like Semrush, SpyFu, or Google’s Ad Preview tool, which all tend to rely on sample data and often do not yield comprehensive examples.

Well, with Google’s latest features, those days are over.

It’s time to get excited about doing competitive ad text research directly within Google Ads.

Where To Find The New Google Ads Research Feature

Just follow these three steps:

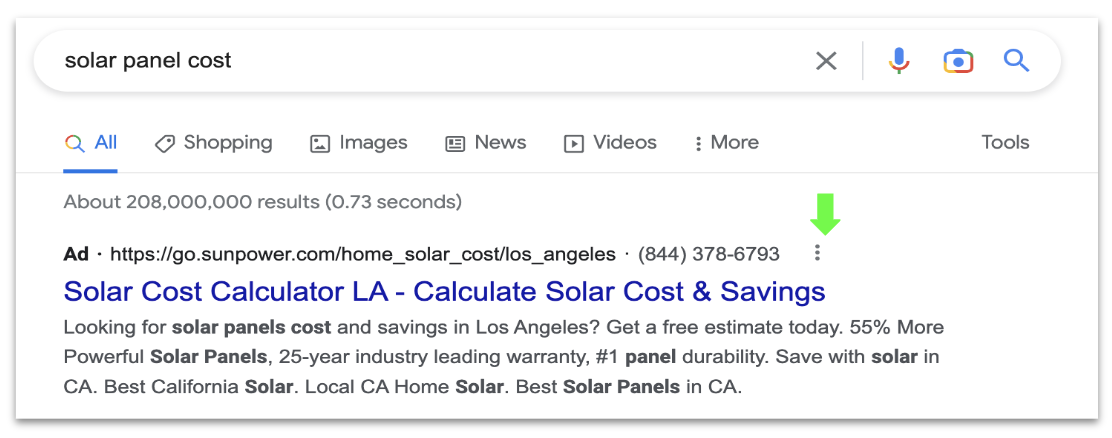

Hover over the hamburger icon next to a paid search ad.

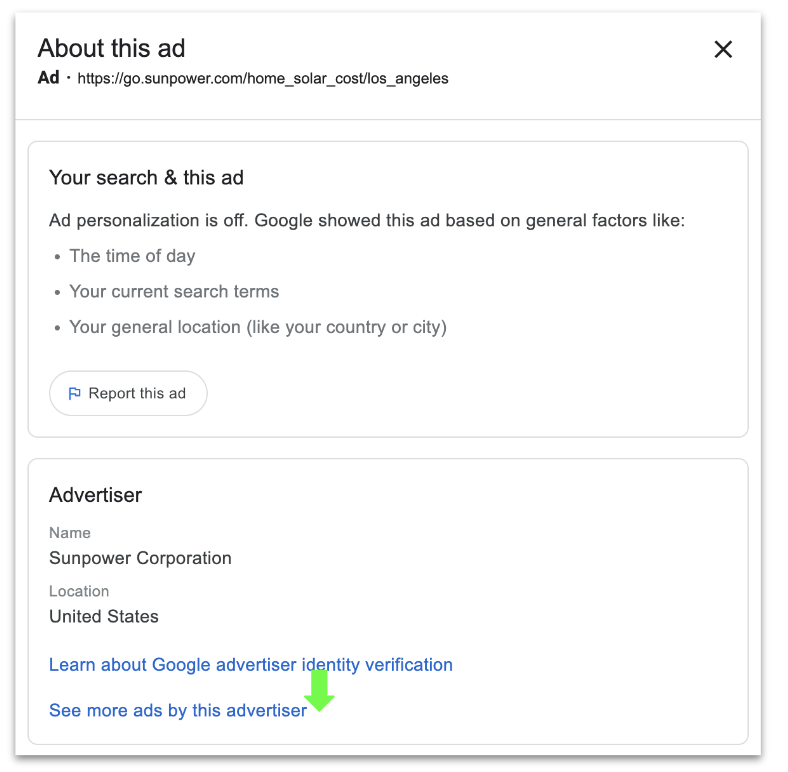

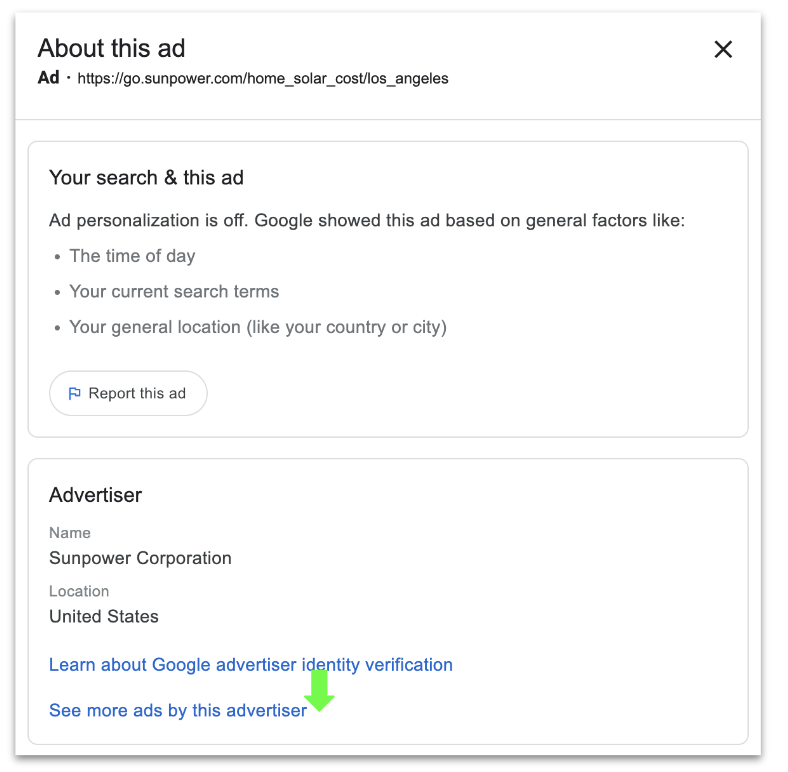

Click on the “See more ads by this advertiser” link.

Screenshot from search for [solar panel cost], Google, November 2022

Screenshot from search for [solar panel cost], Google, November 2022

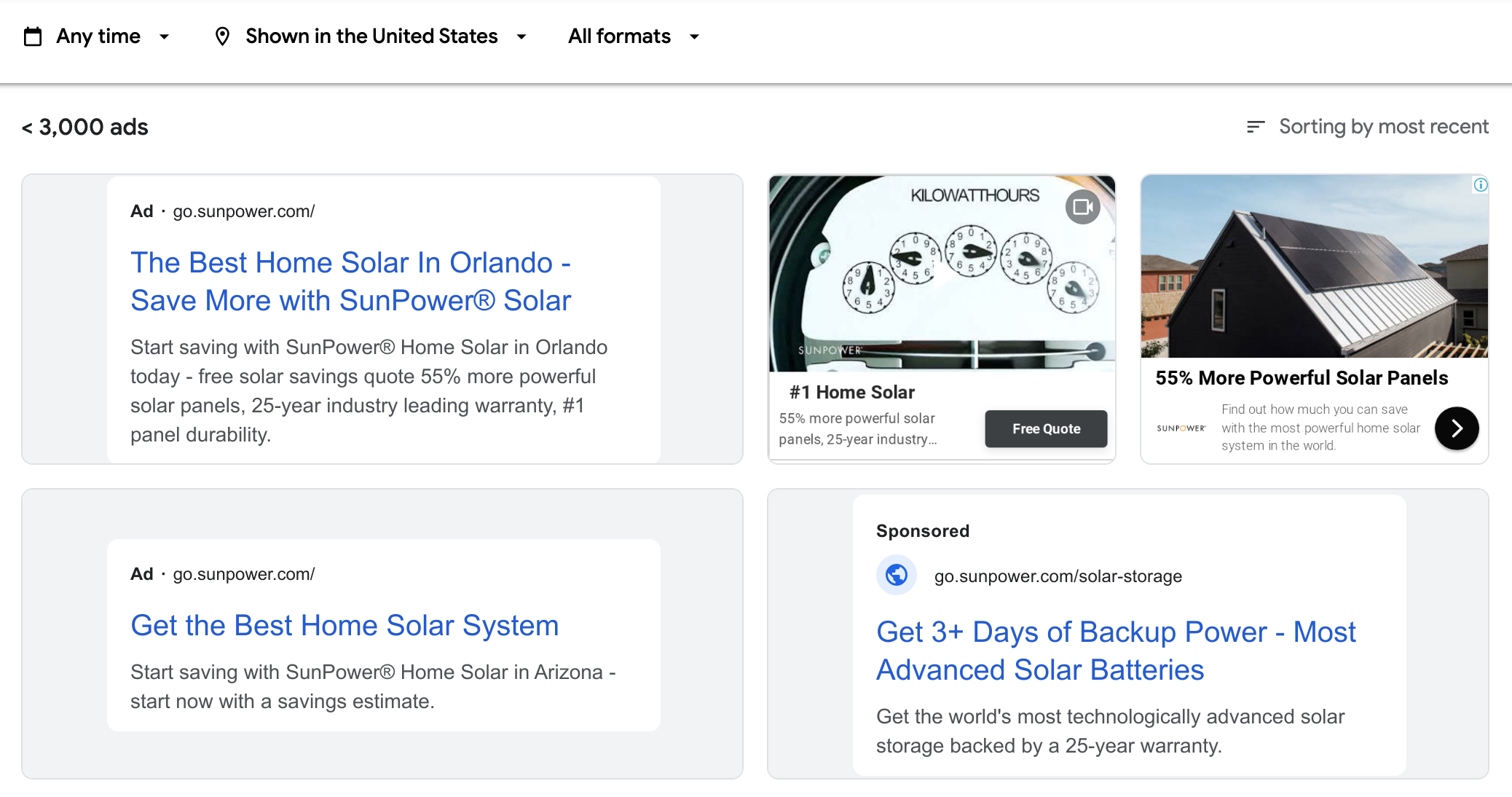

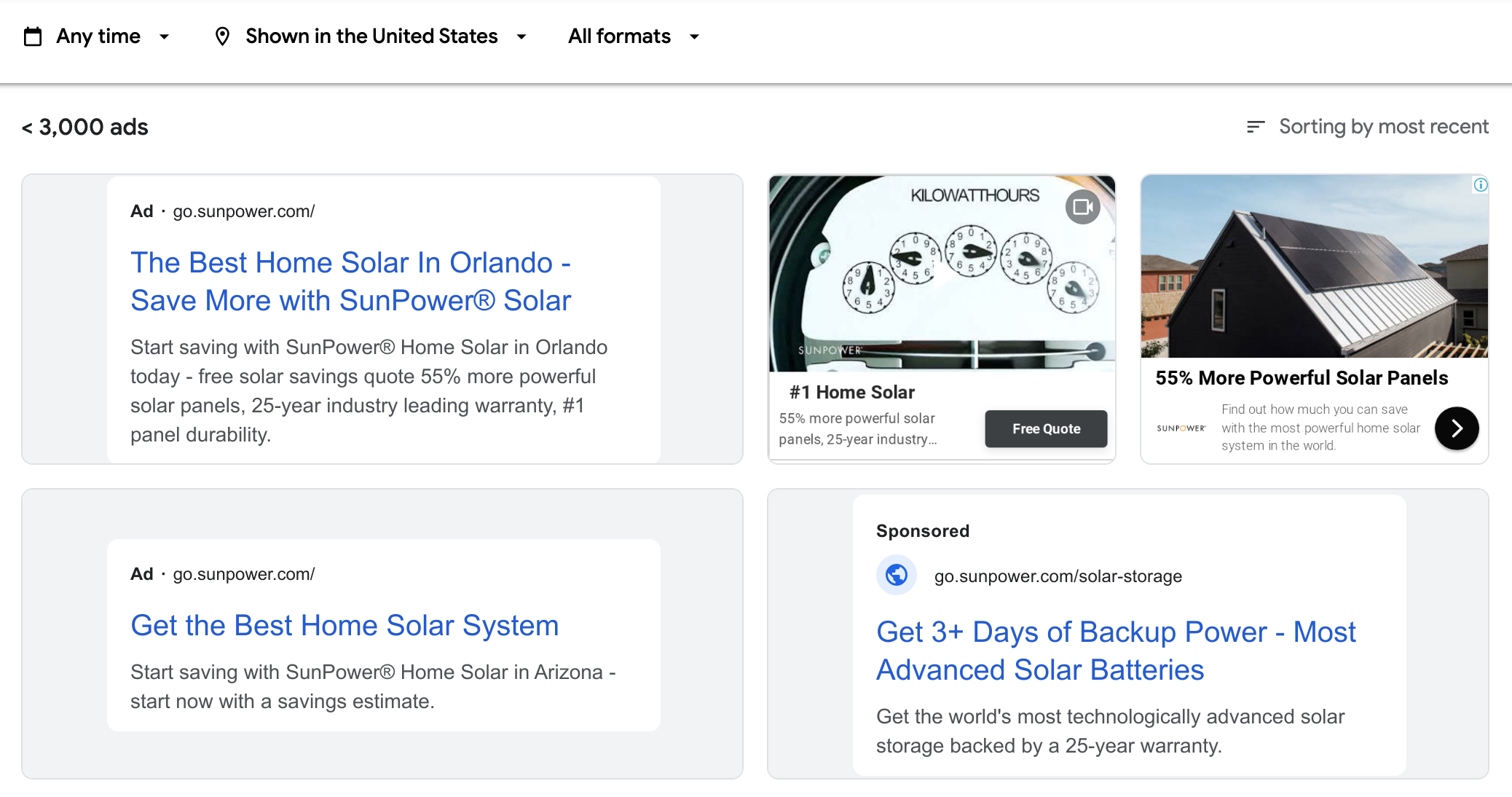

Filter the results by time range, location, and/or ad format.

Screenshot from search for [solar panel cost], Google, November 2022

Screenshot from search for [solar panel cost], Google, November 2022

It is interesting to note that, unlike the Google Ads Preview tool, these features are available without needing to sign into a Google account or your campaign.

Gone are the days of needing a dummy account or having to write a dummy ad to trigger the preview.

The ability to filter by ad format is another important advantage over using the Google Ads Preview tool.

Especially when in a hurry or needing to override the algorithmic ad display customization for your profile, ad format filtering is an excellent way to get just the results you need.

Now, let’s look at how to analyze the ads themselves.

7 Steps To Analyze Paid Search Ad Copy

Whether you’re looking at text-only or non-text copy, follow these steps to create a systematic analysis approach.

This will help you organize insights, detect trends more easily, and create a structure that lends itself to iterative analysis over time.

1. Call To Action

Arguably the most important part of the ad, the call to action (CTA) is what will drive the user to convert.

Take note of any incentives or offers, urgency messaging (e.g., today, now, limited time), the location, and possible repetition of the CTA within the ad.

Sophisticated ad copy should mention the CTA more than once. The first mention may include urgency messaging, with other mentions elaborating to include incentives.

If the product or service is not sold online, as a best practice, the CTA should include the means to buy it, which typically involves calling or visiting a physical store.

2. Product Or Service Name

This is especially key when the product or service is new, technical in nature, has a colloquial equivalent that is sufficiently different from the official brand name, or if the business encompasses multiple aspects.

For example, a printer manufacturer may find it valuable to analyze shortened product names that do not include the full technical specifications.

Similarly, many travel service businesses have lengthy names to reflect all their services, but it is not always necessary to include them in full (e.g., Melia Caribe Beach All-Inclusive Resort Punta Cana).

3. Product Or Service Features

Whether visual or text-based, ads devote significant real estate to describing the notable attributes of the promoted product or service.

Take note of what those are and what qualifying descriptions or visualizations are used.

For text-based ads, take note of the adjectives and adverbs and whether they are superlative or factual.

For non-text ads, track how the product is shown and if the imagery is lifestyle-based or technical.

4. Benefits

While features help describe the use case for a product or service, it is the benefits that will convince a user to engage.

Take note of what solution-oriented language or imagery is leveraged, if any sources are cited to back up claims, and if the described benefits are short- and/or long-term.

Sometimes, multiple levels of benefits may need mentioning, when the consumer is not the ultimate (or only) beneficiary.

For situations akin to gifting, purchasing insurance, education, or caregiver services, marketers often forget that one should address the needs of both the purchaser (e.g., the person buying a gift, who may be cost-conscious) and the recipient (e.g., who might be more concerned with a flexible return policy).

5. Branding

Brand inclusion is another key element to test.

Consider everything from spelling to the presence of trademark symbols, placement in headlines and/or body of the text, logo size, when your brand is mentioned within the ad, and where opportunities exist to include your brand name.

However, be sure not to rely on just the URL.

Every now and then, an advertiser gets caught up with all the other ad elements and forgets to include the brand name or logo, relying solely on the visible URL to do the tough job of communicating the brand name.

Alas, that URL is too often lost in the clutter of the other ad elements.

6. Tone

This last element is perhaps the hardest to pin down.

The ad tone, along with the CTA, is a crucial indicator of which user journey stage the advertiser is targeting.

A more informative, casual tone would suggest targeting a user earlier in their online research journey.

By contrast, an ad that has more direct language is likely aimed at a user in a transactional frame of mind.

7. Length

Last but not least is the ad text length – or, for non-text-based ads, video duration or image size dimensions.

Ads that convey the most compelling story or engage users in the most proactive ways often have the highest likelihood of success.

On the flip side, just because an ad has the option to include a lot of text or include a video of a certain length, it is not always the best-performing approach. Oftentimes, less is more.

Conclusion

These tips on competitive ad analysis would be incomplete without advice on how to use the insights once they are tracked.

The tendency is often to mirror what others are doing. However, that can lead to all players having similar messaging. This only makes it harder for users to differentiate the available options.

While it is worth borrowing ideas from your competitors, resist the urge to copy a perceived market leader. Rather, gather insights from multiple players and then systematically test specific elements.

Standing apart from others will often yield the best results.

Systematically tracking the tested elements will position you well to develop a test results calendar.

Unfortunately, in the long run, there is rarely a single best-performing ad. With the ever-shifting competitive landscape, one has to constantly iterate.

However, there is a silver lining: Retired ads can often stage a successful comeback.

By systematically tracking the use of the above elements in both competitor ads and your own, you can identify trends and detect cyclical patterns.

If you detect a trend reversal, you will be already armed with past research on what has worked well before in these circumstances, ready to anticipate your competitor’s moves, and prepared to respond.

More resources:

Featured Image: eamesBot/Shutterstock

window.addEventListener( ‘load’, function() {

setTimeout(function(){ striggerEvent( ‘load2’ ); }, 2000);

});

window.addEventListener( ‘load2’, function() {

if( sopp != ‘yes’ && addtl_consent != ‘1~’ && !ss_u ){

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

if( typeof sopp !== “undefined” && sopp === ‘yes’ ){

fbq(‘dataProcessingOptions’, [‘LDU’], 1, 1000);

}else{

fbq(‘dataProcessingOptions’, []);

}

fbq(‘init’, ‘1321385257908563’);

fbq(‘track’, ‘PageView’);

fbq(‘trackSingle’, ‘1321385257908563’, ‘ViewContent’, {

content_name: ‘google-new-ad-insights-tips-competitive-ad-research’,

content_category: ‘paid-media’

});

}

});

Source

[sibwp_form id=1]