Community isn’t a single Slack group or event or newsletter. It’s an aggregation of all of these touch points, and includes both customers, eventual customers and one-time users. Despite this nebulous, disconnected reality, companies are paying more attention to various channels as remote work and digital communication powers our days. My recent tweet underscored the chord community strikes even in sectors such as edtech, which often have to sell to fragmented customer bases.

A conversation that I’ve been having over the last week is that startups are finally investing in community in a meaningful way, dedicating actual budgets to community instead of simply stealing a few dollars away from the sales and marketing team.

As one founder told me, “chief community officer is the new CMO.” That piqued my interest, especially because I had just talked to Commsor founder Mac Reddin about his recent funding, a $16 million Series A led by Felicis and Seven Seven Six Ventures.

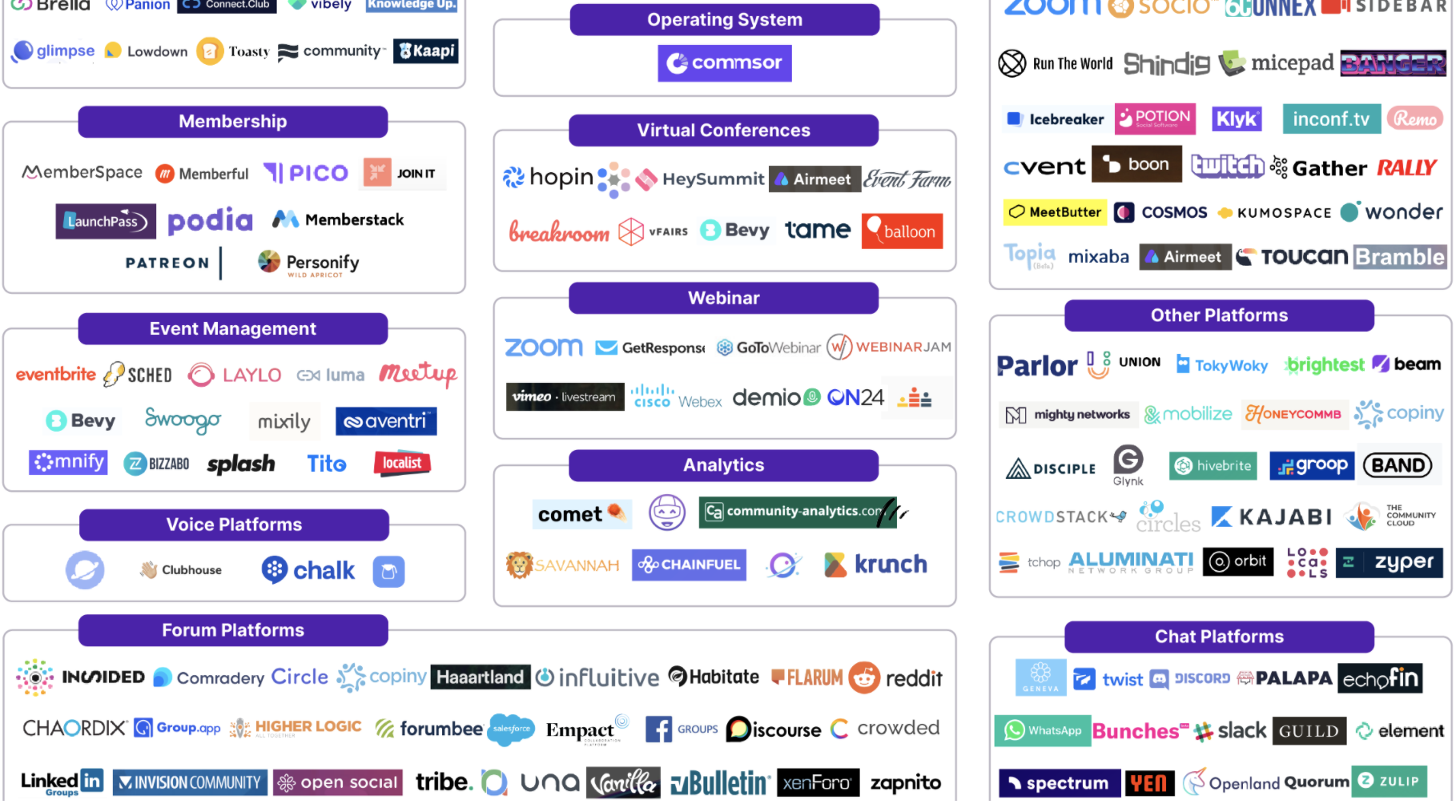

As the ‘aha’ moment of community continues, Commsor is a solution to help community managers prove that they’re not wasting the budget, and outcomes. Commsor, he says, is the operating system for communities, helping companies distill how their different communities look, and feel, which could eventually trickle down into generating sales leads and revenue. Commsor could pull an insight like, ‘here are three engineers that are using your platform from Google, maybe it’s time to approach Google and ask if they want an enterprise contract.” Finding those sweet spots, and bottoms-up community adopters, is Commsor’s bread and butter.

Commsor, which is still in private beta, says that over the last year there has been a “huge increase” in startups that have a community budget or increase in community budget. To be a startup aiming to disrupt a category that still has a tone of gray in it comes with its own challenges.

Commsor launched C School to help aspiring community managers learn the trade, as well as a fund to back companies in the space. It also posted a memo with signatures from companies like Hopin, Lattice and Notion to show the commitment to defining the community space.

“We are kind of what Customer Success was 10 years ago, or what Revenue Operations was 300 years ago,” Reddin said. “People care about it and there are roles, but there’s still a lot of defining and growth to be done.”

Market map of community tools.

In the rest of this newsletter, we’ll get into early-stage startup competition, the pipeline problem, and Bitcoin breaking barriers. As always, you can find me on Twitter @nmasc_ or e-mail me [email protected]. Want Startups Weekly in your inbox every Saturday. Sign up here.

Will your investor put money into a competitor?

When an investor backs a startup, they ideally think that the company will be the winner in said category, whether it’s CBD gummies, financial plumbing or peer-to-peer car-sharing. So, if they place a bet in a competing startup the investment could serve as both a negative signal and a reputation hit.

Here’s what to know, via Alex Wilhelm: As software markets mature, maybe the investing playing field is opening up to investing in competitors? Call it conveniently complementary investments.

Etc: In this week’s Equity episode, we talked about the complexity of competition within startups, and how one firm’s investments seem to all perfectly and conveniently fit into each other. I’ll make you listen to the episode to figure out who, but here’s a hint: Is there a world where Dispo creators track monetization from Clubhouse through Stir?

Image Credits: TechCrunch

An Olive startup competes with Amazon

Ambitious early-stage founders often have to answer a common question from investors and journalists: What if Facebook, Apple, Amazon, Netflix or Google built your startup? The idea behind the question is figuring out why a founder is specifically and uniquely qualified to solve a problem, even if a behemoth business throws millions of dollars and a team of engineers at it.

Here’s what to know via Jet co-founder Nate Faust: He sold his business to Walmart for $3 billion in 2016, and now he’s back to compete with Amazon with a sustainable e-commerce play. Olive consolidates a shopper’s purchases into a single weekly delivery in a reusable package.

Faust acknowledged that Olive runs counter to the “arms race” between Amazon and other e-commerce services working to deliver purchases as quickly as possible. But he said that the startup’s consumer surveys found that shoppers were willing to wait a little longer in order to get the other benefits.

Etc: If you were wondering when it makes sense to compete with Zoom, these four edtech startups and Google might have some information for you.

Image via Getty Images / alashi

Bust the myth of the pipeline problem

The lack of diversity in Silicon Valley, from the check-writers to the employees, has often been chalked up to the pipeline problem: the idea that there isn’t enough enough diverse, qualified talent to fill roles. But recent research underscores how aged, and flawed, this mindset might be. Reporter Megan Rose Dickey interviewed Dr. Joy Lisi Rankin, a research lead for gender, race and power in artificial intelligence at the AI Now Institute.

Here’s what to know, according to Rankin:

“The pipeline is a way to silo all of that out and say, ‘we just need to get more Black women in tech,’ as opposed to saying, ‘actually, these companies are and have been racist and white supremacist and misogynist, and it’s those institutions and larger societal and global capitalist structures that need to change.”

Rankin adds that transparency around hiring and corporate recruiting could help combat biases and signal important information to talent.

Etc: At TC Sessions: Justice next month, we’ll be talking about how research like this, as well as structures within venture capital, impacts early-stage founders. Speakers include Arlan Hamilton, the founder of Backstage Capital, Brian Brackeen of Lightship Capital, and others. Get your tickets here for $5.

Around TechCrunch

TC Sessions: Justice 2021 kicks off in two weeks

Announcing the TC Early Stage Pitch-Off

Across the week

Seen on TC

Bitcoin breaks the $50,000 barrier as Coinbase’s direct listing looms

Clubhouse has topped 8 million global downloads, per report

YC-backed Queenly launched a marketplace for formalwear

Uber extends work from home policy through mid-September

Why two startups are betting on debt instead of equity

Seen on EC

Pandemic-era growth and SPACS are helping edtech startups graduate early

Investors SPAC push could revapm the private market money game

Dear Sophie: Tips for filing for a green card for my soon-to-be spouse

Why do SaaS companies with usage-based pricing grow faster

Paying $115B for Stripe or $77B for Coinbase might be quite rational

And for dessert, read this piece on how 10 investors predict MaaS, on-demand delivery and EVs will dominate mobility’s post-pandemic future.

See y’all next week,