Fintech startup Klarna is turning its mobile app into a banking app in Germany. Customers living there can now open a consumer bank account and get a Visa debit card.

For now, Klarna is launching bank accounts for a limited number of users. The company expects to roll it out more broadly in the coming months.

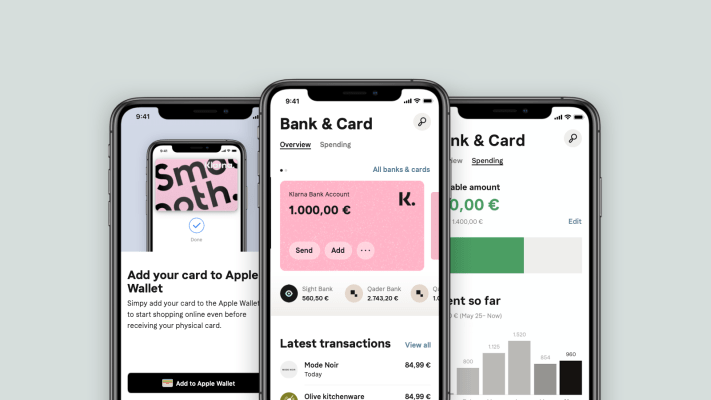

What you get is a full-fledged bank account with a German IBAN to receive money, set up direct deposits and debits. The debit card works with Google Pay and Apple Pay. You get two free ATM withdrawals per month.

With today’s launch, Klarna wants to build a financial super app. Klarna started as a payment method for e-commerce websites. It lets you pay for expensive goods over multiple installments. Merchants get paid when the initial transaction occurs, with Klarna transparently managing credit lines for customers.

With the company’s mobile app, you can track your past purchases and your upcoming payments. The app also lets you access a marketplace of stores, track deliveries and set up price-drop notifications.

But you couldn’t get a full overview of your finances with this data. Adding a bank account provides full visibility in everything that lands on your bank account and leaves your bank account.

It could open up some new opportunities for credit lines. For instance, if you pay in store for something really expensive with your Klarna card, you could receive a notification that suggests spreading out your expense over three months.

Klarna also plans to add savings goals and savings accounts. The startup has already launched savings accounts in Sweden. It offers flexible and fixed-term savings accounts.

Klarna has built its own core banking system, which means that it doesn’t rely on a banking-as-a-service partner to manage your bank account. It’ll compete with other digital banks in Germany, such as N26 and Vivid Money.