Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week we’re looking into the app store bill in Arizona, the trend of animating family photos and what’s next for Twitter’s Clubhouse rival, among other things.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters.

Arizona House passes a bill that would allow developers to avoid the “Apple tax”

Image Credits: Apple

The Arizona House of Representatives this week passed a bill (HB 2005) that could significantly impact Apple and Google’s grip on the App Store market. Unlike a similar measure recently shot down by the North Dakota Senate, this new bill doesn’t force app stores to offer alternative ways for developers to distribute their apps. Instead, it focuses on giving developers the right to use third-party systems that would allow them to circumvent the 15%-20% cut that Apple and Google take from app sales, in-app purchases and subscriptions.

Apple and Google lobbyists were already fighting against this bill before it was even formally introduced by Arizona State Rep. Regina Cobb. Cobb says she was approached by a lobbyist representing Match Group and the Coalition for App Fairness (CAF) — the latter, which has organized some of Apple’s largest competitors — like Epic Games, Match Group, Spotify and Tile — to fight back against Apple’s control of the app ecosystem.

CAF had also backed the North Dakota bill,, and is helping push legislation in other states, including Minnesota, Georgia and Hawaii.

Some legislators may oppose the bill on the grounds that these decisions are more of a federal matter and concerns over how the state would be able to enforce such a policy. The Arizona bill still has to make it through the Senate (and could be vetoed by Governor Doug Ducey) in order to become a law. If it did pass, it would make Arizona an attractive place to set up an app business and could set the groundwork for other states to pass similar legislation.

Animated family photos top the App Store

MyHeritage’s recently launched update that lets users animate their old photos helped to send the app to the top of the App Store this week. The company had last week introduced “Deep Nostalgia” — a facial animation feature powered by technology from Israeli tech company (and TechCrunch Battlefield alum) D-ID. To animate the photos, the tech maps the facial features from the photo to a driver video to create what it calls a “live portrait.”

The app went viral on social media, including TikTok, as people used the photo to animate long-ago relatives and other historical figures.

@thomasflanigan_The app is called MyHeritage ##greenscreenvideo ##myheritage ##McDonaldsCCSing ##ancestors♬ record before u listen – penny lane

But in a number of more touching videos, people film themselves reacting to seeing their mom or dad “come to life” again through the tech, blinking, smiling and nodding, often set to “Remember When” by Alan Jackson or “Sign of the Times” by Harry Styles as the background track.

Though MyHeritage shot up to become the No. 1 Overall app on the App Store as of Tuesday, a smaller startup, Rosebud, quietly pivoted to address the same use case with its TokkingHeads app. The app, founded by Berkeley PhD Lisha Li, was originally intended for making funny videos and memes with friends, video game avatars or celebs by animating portrait photos with text, speech and puppetry via video — but not so well that it would cross into “deepfake” territory.

But after the release of MyHeritage’s update, TokkingHeads quickly updated to alert users to its own feature set, while also elevating the MyHeritage-like animations it offers in the app. As a result, the app started to gain a following of its own. On February 28, 2021, TokkingHeads saw 1,000 downloads. The next day, it had 8,000 downloads. The following two days, March 2 and 3, it saw 24,000 downloads and 28,000 downloads, respectively.

The app has since reached as high as No. 12 in the App Store’s Entertainment category, as of the time of writing, and No. 94 Overall. (And was climbing daily.)

@mirandasevier#tokkingheads #fyp♬ Go Rest High On That Mountain – Vince Gill

The YC-backed startup’s ambitions extend beyond animated photos, however. It’s been developing internal tools which it used to generate backgrounds and visuals for use in personalized media. It’s been testing these tools with personalized meditation videos on TikTok, but isn’t yet ready to fully announce a new product. Rosebud is backed by $2.2 million in seed funding led by Khosla Ventures, with participation from Twitch COO Kevin Lin, OpenAI co-founder Ilya Sutskever, former Coinbase CTO Balaji Srinivasan and others.

Platforms: Apple

Image Credits: TechCrunch

Apple clarifies you can’t actually set a “default” music service in iOS 14.5. It explains that the Siri feature that asks you how you want to play the music or other audio (like podcasts or audiobooks) that you’ve requested is only an example of Siri Intelligence, and is not technically making that service a “default.”

Apple’s courtroom battle with Epic Games over the App Store’s alleged anti-competitive behavior is set to start May 3. The judge believes the case is significant enough to hold an in-person trial with witnesses.

The U.K.’s anti-competition authority, CMA (Competition and Markets Authority) is opening its own investigation into Apple’s App Store, following a number of complaints from developers alleging unfair terms.

Apple releases iOS 14.5 beta 3. The new release adds a notification banner to iPhone if you have your Apple Watch set to unlock your paired phone; brings back the Siri feature to choose your preferred audio app for certain requests; updates the Find My screen with plans to support accessories; and makes reference to Apple Card Family features, among other things.

In a bit of App Store history revealed this week, Apple’s Scott Forstall once told Pandora to use jailbroken iPhones to develop their music app ahead of the App Store’s launch.

Apple shuts down Buddybuild, the app development service it acquired in 2018. The team had joined the Xcode group at Apple, but Buddybuild remained online for existing customers. An email has now informed those customers it will cease operations on March 31, 2021.

Apple’s upcoming AirTags gains an anti-stalking feature. In the latest iOS 14.5 beta, a new “Item Safety Features” option was found to be on by default. It would warn you if someone secretly hid an AirTag in your possessions.

Platforms: Google

Google Play announced it’s reducing the minimum price limit for products in over 20 markets across Latin America, EMEA and APAC. In these markets, developers can now set prices in the range of 10-30 cents U.S. equivalent — or “sub dollar” prices. Google says this will allow developers to reach new potential buyers.

Image Credits: Google

Google debuted Flutter 2, an upgrade that broadens Flutter from a mobile framework to a portable framework. Flutter 2 will allow developers to ship native apps across iOS, Android, Windows, macOS and Linux, as well as web experiences for Chrome, Safari, Firefox and Edge, and cars, TVs and smart TVs. Google says there are now more than 150,000 Flutter apps on the Play Store today, including WeChat, Grab, Yandex Go, Sonos, Betterment and others.

The Google Play Console added a new suite of metrics and comparison benchmarks that will allow developers to evaluate the app’s engagement and monetization against up to 250 different peer sets.

E-commerce

Twitter tests new e-commerce features for tweets. The company was spotted testing a different style of organic tweet which includes product info, pricing and a big “Shop” button. The company confirmed it’s one of many commerce tests in the works.

Amazon’s mobile app got a new icon…again. Customers complained the first iteration, which featured Amazon’s smiling arrow across a brown box with a piece of blue tape at the top, reminded them of Hitler. The updated look gives the tape a smooth edge.

Augmented Reality

The Google Play Service for AR app, which delivers ARCore updates to Android phones, was updated to include support for dual cameras instead of just one, as before. The change was spotted by Android Police, which noted that the support would arrive on Pixel 4 devices first.

Fintech

More evidence of Apple Card Family support spotted in iOS 14.5 beta 3. The new feature will allow family members to share the same Apple Card through iCloud Family Sharing, so each member can access the card in the Wallet app.

Social

Image Credits: TechCrunch

Twitter Spaces beat Clubhouse to Android. Twitter’s social audio service and Clubhouse rival, Twitter Spaces, has been iterating at a rapid pace. The company has been sharing features in public as they’re designed and prototyped, including titles and descriptions, scheduling options, support for co-hosts and moderators, guest lists and more. Twitter also updated the preview card that appears in the timeline and relabeled its “captions” feature to be more accurate, from an accessibility standpoint. This fast pace of development allowed the new product to reach Android users this week, ahead of Clubhouse. However, Android users can only join Spaces for the time being, they can’t host them. Still, the move will help to serve the pent-up demand for social audio among a huge chunk of the mobile market.

LinkedIn says it will stop using IDFA ahead of the iOS App Tracking Transparency launch. The business social network is getting ahead of the change and says it will instead leverage “first-party data” to help advertisers.

Instagram accidentally hid “likes” for a number of users in the U.S., who were unintentionally added to the ongoing test where likes are no longer displayed. The company attributed this to a bug and said it was fixing the issue ASAP.

Right-wing social app Parler had dropped its lawsuit against AWS to get its cloud hosting services reinstated, but its fight isn’t over yet. In a new case, Parler is now going after Amazon with more charges, including defamation, negligence and breach of contract. The suit claims Parler lost “tens of millions” of users and future users” as well as “hundreds of millions” in revenue.

TikTok adds a Business Profile section for marketers and brands. The section offers marketing tips, insights on app usage and advertising events — and likely, in the future, e-commerce tools.

TikTok forms a Safety Advisory Council in Europe, following the death of a girl who fatally attempted the blackout challenge she saw on the app, leading to emergency intervention by Italy’s data protection authority.

Instagram launches “Live Rooms” for live broadcasts with up to four creators. Previously only two people could go live. The launch has a bit of Clubhouse envy to it, as Instagram notes it could be used for things like talk shows, Q&As and interviews, for example. A similar feature has been spotted in TikTok in recent weeks, as well.

Facebook launched BARS, a TikTok-like app for creating and sharing raps. In the app, users react with “fire” emoji while flipping through a full-screen, vertical video feed of people’s raps.

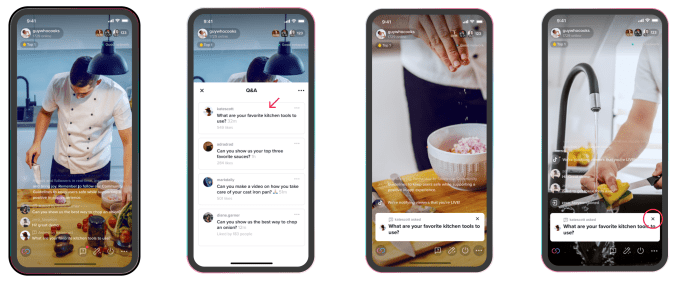

TikTok launches TikTok Q&A. The new feature will allow creators to respond to viewer questions with either text or video replies, including during livestreams. The questions and answers will also be organized in a new Q&A page, linked from the bio. The feature is a direct response to how many creators were already using the app to interact with fans.

Image Credits: TikTok

Photos

Apple introduced a service that will allow iCloud users to transfer their photos and videos to Google Photos. Anti-competitive scrutiny cracks the walled garden, it seems.

MyHeritage tops the App Store after launching a new feature called Deep Nostalgia that animates users’ old family photos.

Messaging & Communications

WhatsApp brought voice and video calls to the desktop companion app. The calls are end-to-end encrypted, and will later expand to include group calls.

WeChat updates its emojis to dial down the violence. It removed the cigar from the smoking soldier emoji and removed the blood from the meat cleaver emoji. It also no longer shows a hammer hitting a head — it’s now a frying pan.

Streaming & Entertainment

Image Credits: Netflix

Netflix launches “Fast Laughs,” a TikTok-like feed of funny videos. The mobile feature is currently iOS-only and lets users flip through a full-screen vertical video feed with short clips from Netflix programming, react, share and add items to a watchlist or immediately start streaming.

Apple pulls Music Memos, a music creation tool, from the App Store. The app was used to analyze rhythm and chords from acoustic guitar and piano recordings. The company advised users to export their content to Voice Memos library instead.

Hulu brings back picture-in-picture mode with the latest iOS update. The feature had been available previously, but was pulled so Hulu could make refinements.

Spotify’s podcast listeners in the U.S. expected to top Apple Podcasts for the first time in 2021, at 28.2 million listeners on Spotify versus 28 million on Apple Podcasts.

Gaming

Image Credits: Genshin Impact (via Sensor Tower)

Genshin Impact from miHoYo has reached $874 million in consumer spend since its September 2020 launch, reports Sensor Tower, making it already the world’s third-highest-earning mobile game.

Hypercasual games are now the largest genre for game downloads, a separate Sensor Tower report says. The genre has expanded from a 17% share of downloads in 2017 to now 31% in 2020. Other genres seeing growth include Arcade and Puzzle, increasing by 33% and 78% respectively.

Books and Reading

Flipboard expands its local coverage to over 1,000 cities and towns. The company last year launched a broader initiative around local news, allowing users to follow their local publications, TV stations, blogs and more.

Google Play Books was updated with new tools for younger readers, including “Read & Listen,” which will let kids listen to a book read out loud, “Tap to Read” to hear words spoken out loud and a kid-friendly dictionary.

Health & Fitness

COVID-19 exposure notification apps have still not seen widespread adoption, USA Today reports. Fewer than half of U.S. states offer the contact-tracing apps, and most people in participating states don’t use them.

Amazon Halo users, the app-paired health and fitness tracker from the retail giant, is being integrated with Alexa. The new feature will let you ask Echo and other Alexa devices for health stats.

Best Buy Health partnered with the Lively app to offer a range of health and safety services aimed at older adults on Apple Watch. Apple Watch users can use the app to get emergency and non-emergency assistance from the Lively agents and receive additional protection from things like Fall Detection.

Period tracking app Clue gets FDA clearance to launch a digital contraceptive. The app’s algorithmic prediction is based on Bayesian modeling and can display the days where there’s a higher risk of pregnancy.

Jamaica’s JamCOVID mobile app and website were taken offline following their third security lapse. The platform was exposing quarantine orders on over than half a million travelers.

Productivity

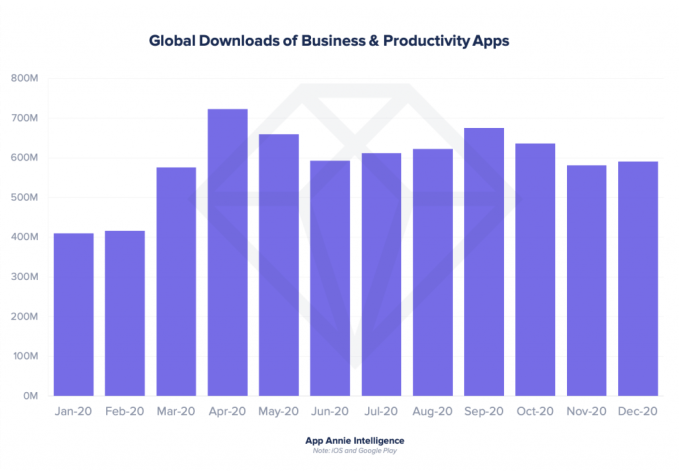

Image Credits: App Annie

Business and productivity apps reached 7.1 billion downloads in 2020, up 35% YoY, reports App Annie. The jump was attributed to the pandemic, with the biggest surge coming in mid-March when shelter-in-place orders kicked in.

Microsoft pulled the Delve mobile apps from the App Store and Google Play, which will be followed by a full shutdown of the service in June. Delve was designed to surface relevant info and insights using the Office Graph. Users were redirected to Outlook Mobile, which has some similar features.

Microsoft launched Group Transcribe, a new kind of mobile transcription app for in-person meetings. The app requires all meeting participants to record from their own phones, which improves accuracy and speaker identification. It also offers real-time translations to help non-native speakers follow along.

Security & Privacy

Thousands of Android and iOS app are leaking data from the cloud, Wired reports. In analysis run on more than 1.3 million Android and iOS apps, researchers found almost 84,000 Android apps and nearly 47,000 iOS apps used public cloud services. Of those, misconfigurations were found in 14% — 11,877 Android apps and 6,608 iOS apps — which were exposing personal information, passwords and medical information.

Hackers released a new jailbreak tool for almost every iPhone by using the same vulnerability Apple said last month was under active attack by hackers. The jailbreak, released by the Unc0ver team, works on iOS 11 to iOS 14.3, and iPhone 5s and later.

Google’s apps with privacy labels have begun receiving updates after lengthy pause. Apps that have started to get updates include Gmail, Slides, Docs, Sheets, Calendar, YouTube, YouTube TV, YouTube Music, Google Tasks and Google Podcasts. Google’s key apps still missing labels include Search, Photos, Assistant, Maps, Pay and Chrome.

? Stream raised $38 million for its service that lets developers build chat and activity feeds into apps with a few lines of code. The company now powers communications for 1 billion users, including in apps like TaskRabbit, NBC Sports, Delivery Hero, Gojek and others.

? Whatnot raised $20 million in Series A funding for its livestreaming platform for selling collectible toys and cards. The round was led by a16z, and follows a $4 million seed raised at the end of 2020.

? Snapcommerce raised $85 million for its platform that uses messaging to personalize the mobile shopping experience. Inovia Capital and Lion Capital co-led the new growth round, bringing the startup’s total raise to date to $100 million.

? Food delivery app Instacart raised $265 million at a $39 billion valuation. The round was raised from existing investors, including Andreessen Horowitz, Sequoia Capital, D1 Capital Partners and others and pushes the valuation up from $17.7 billion in October 2020.

? Okta acquired cloud identity startup Auth0 for $6.5 billion. Auth0 offers authentication and security for apps across native mobile, desktop, and web apps. Following the deal, Auth0 will continue to operate as an independent unit inside Okta.

? Fintech Square acquired Jay-Z’s streaming service TIDAL for $297 million. Perhaps those yachting trips paid off? Square plans to offer financial tools to artists to help them collect revenue. Despite the deal’s seeming oddness, a good bet is that Square plans to expand into music-based NFTs.

? App marketing company AppLovin filed its S-1 ahead of its IPO. The company was valued at $2 billion in 2018, but posted a net loss of $125.9 million in 2020 on revenue of $1.45 billion, up 46% YoY. The company warned investors that it may be impacted by Apple’s IDFA changes.

? Maestro raised $15 million for its interactive commerce, community and engagement tools for livestreams across web and mobile. Maestro can also be embedded into native mobile apps using a web view.

? Indie weather app Weather Line acquired. The company didn’t provide any details on its acquisition, including the buyer, but said the app will be removed from the App Store. Existing users will continue to have access until April 1, 2022.

? Indian jobs app Apna raised $12.5 million in a round led by Sequoia Capital India and Greenoaks Capital. The app is now used by 80,000 employers and 6 million+ workers such as drivers, delivery personnel, electricians and beauticians.

? Istanbul’s Dream Games raised $50 million and launched its first mobile gaming title, Royal Match. The round, led by Index Ventures, is the largest Series A raised by a startup in Turkey.

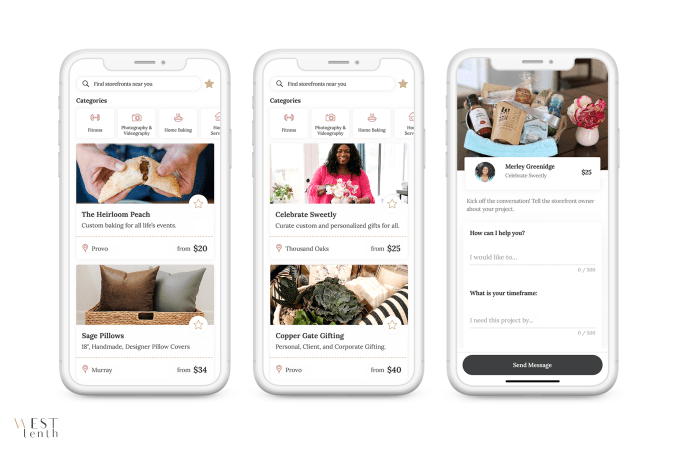

West Tenth

Image Credits: West Tenth

West Tenth’s new app aims to give local home-based business owners a platform to reach potential clients and make sales. The app focuses on women who have opted out of the traditional workforce to stay home, often to raise kids and work more flexible hours. Often targeted by predatory MLMs, West Tenth aims to convince women that many of their everyday skills are, in fact, marketable businesses — like cooking and meal prep, party planning, interior design, photography, home organization, baby sleep training, fitness instructions, homemade crafts and more. The startup also offers online education classes to teach women the basics of marketing and running a home business. (iOS and Android)

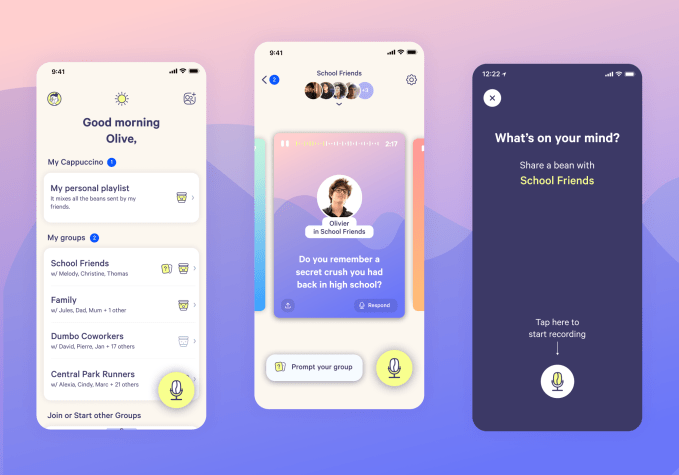

Cappuccino

Social audio is growing in popularity thanks to apps like Clubhouse and Twitter’s Spaces. A startup called Cappuccino, reviewed here by TechCrunch, now wants to bring social audio to a more intimate setting: groups of friends. The anti-Clubhouse app lets friends record “podcasts,” which are designed for private consumption. (iOS and Android)