The wave of shared electric scooters that swept through cities several years ago helped Populus AI get its start. Now, surging demand for delivery — and the pressure it places on curb space — is helping the transportation data startup attract new capital and expand to more cities.

Populus, a San Francisco-based startup founded in 2017, has raised $5 million from new investors Storm Ventures and contract manufacturing and supplier company Magna along with existing backers Precursor, Relay Ventures and Ulu Ventures. The company has raised nearly $9 million to date.

Populus plans to use that capital to expand to more cities, growth that the company believes will be driven by demand for street and curb management. Populus has contracts with more than 80 cities, including Oakland, San Diego, and Tel Aviv, and works with more than 25 micromobility operators. Co-founder and CEO Regina Clewlow said their aim is to triple the number of cities over the next 18 months.

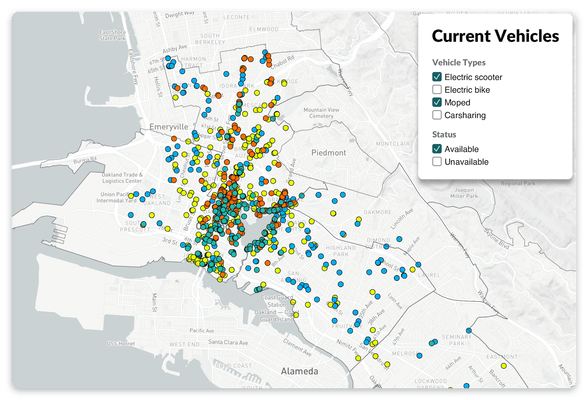

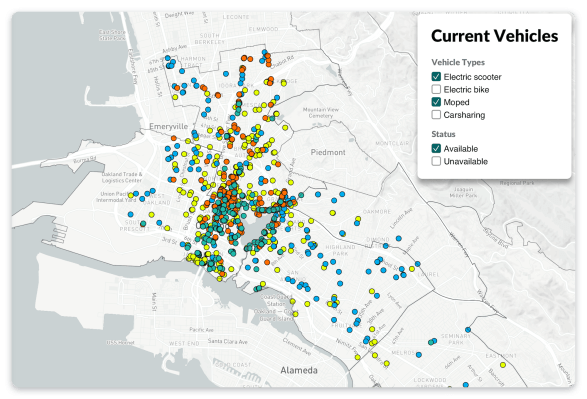

The Populus platform is a software as a service product that operates like a two-way street. The company pulls data from fleets of shared ebikes, scooters, mopeds and car-sharing and delivers that information to cities to help planners and regulators understand and manage how streets and curbs are used. Cities can also use the Populus API to share its rules of the road — restrictions on motorized vehicles, preferred scooter parking areas and information on bike lanes, for instance — to mapping platforms and any other third party.

“In recent years, there has been significant growth in venture-backed startups delivering software to cities, especially as transportation becomes increasingly connected and automated,” Frederik Groce, a partner at Storm Ventures and founder of BLCK VC said in a statement “Populus is uniquely positioned as the market leader to support cities’ digital transformation.”

Last year, Populus added a street manager to the platform to allow cities to communicate new policies such as slow or shared streets that prioritize bikes and pedestrians, areas designated for outdoor dining and construction closures.

The curb management feature, which was also added last year, will be the main driver of growth in 2021, Clewlow said. Cities can use that data to set dynamic pricing for curb space, for example.

“What most cities really want to use our digital technology for is managing commercial fleets including delivery,” Clewlow said. Curb space is being used by both scheduled and on-demand vehicles, she said, adding that these areas are not designed for the volume of deliveries that occur today.

“Cities are continuing to see a boom in delivery; that’s a trend that predated COVID and obviously accelerated during COVID,” Clewlow said. “A real pain point for cities is managing how that space is used by commercial delivery vehicles.”