Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year

This week we’re diving into how Apple is defending its App Store fees amid the Epic lawsuit and how it responded to the other complaints raised by Spotify, Match and Tile in the Senate antitrust hearing. We’re also looking at new data that implies Facebook’s grip on social is starting to loosen, TikTok’s new features, tests and plans for e-commerce, security issues with Twitter’s Tip Jar and more.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters

Apple talks App Store fraud

Apple wants developers to know what they’re paying for with those App Store commissions. The company this week announced it stopped more than $1.5 billion in potentially fraudulent transactions in 2020, preventing theft of customers’ “money, information and time,” it said. And it kept nearly a million “risky and vulnerable” apps out of customers’ hands — meaning it rejected them from the App Store following their review. It also terminated 470,000 developer accounts in 2020 and rejected an additional 205,000 developer enrollments over fraud concerns. On the customer side, Apple deactivated 244 million customer accounts due to fraudulent and abusive activity, it said, and rejected 424 million attempted account creations because they “displayed patterns consistent with fraudulent and abusive activity.”

The company, of course, didn’t just randomly decide to post these figures. Its App Store fees and their legality, of sorts, are on trial as part of Epic Games’ lawsuit. The Fortnite maker alleges Apple is behaving as a monopolist by forcing app developers to use only Apple’s own payment mechanism — and by not even allowing developers to tell their customers where else they can make purchases, such as on the developer’s website, where App Store fees wouldn’t apply.

By publishing this data, Apple is attempting to position all the stories of fraudulent apps on the App Store as those that fell through the cracks of its much larger anti-fraud operation. That is, for all the mistakenly published fraudulent apps that Apple either internally fretted over, or those that have now come to light in the press (often now thanks to developer Kosta Eleftheriou‘s ongoing efforts), there were much, much larger numbers that Apple had stopped from making it through app review.

Where Apple’s case falls apart, however, is when Eleftheriou exposes how easy it is to find those scam apps after they mistakenly get approved. On his own, he’s building a tool that finds scams across the entire App Store. The question is, why can’t a multibillion-dollar company do the same — or even do more? A system that’s able to retroactively review apps that have both high revenues and a suspicious number of five-star reviews (amid a sizable amount of one-star reviews calling the app a scam), would give Apple’s app review team a good place to start a cleanup. The company has done widespread App Store sweeps in years past to get rid of junk, after all — maybe it needs another?

Facebook’s dominance is slipping

There are some signs that Facebook’s hold on the social app ecosystem is slipping. Already getting beat by TikTok and others as the most-downloaded apps of 2020, new data from Appfigures indicates Facebook’s app has been seeing an increasingly smaller number of monthly downloads over the past 12 months.

The Facebook app and Facebook Lite saw 15 million installs per week in May 2020, which dropped to 13 million in June 2020. As of April 2021, the number is now under 11 million — a loss of 23% of downloads in around 12 months. Meanwhile, a social app gaining downloads during this time has been TikTok, which saw 52 million downloads in April 2021.

Image Credits: Appfigures

In addition, eMarketer reported this week that Gen Z users now use TikTok more than Instagram in the U.S. This year, TikTok will have 37.3 million monthly active Gen Z users compared with 33.3 million Gen Z MAUs on Instagram. Snapchat is still leading, however, with 42.0 million MAUs this year. However, TikTok is on pace to surpass Snapchat as well, with 89.7 million total MAUs by 2023, compared with Snapchat’s 98.5 million.

Platforms: Apple

Apple expands its Apple Developer Academy to Detroit and Korea. The program provides training and tools to aspiring iOS developers and designers. Apple already runs programs in more than a dozen other sites in Brazil, Indonesia and Italy.

Apple releases third developer beta and public beta of iOS 14.6 and iPadOS 14.6, and the third developer beta and public beta of watchOS 7.5 The betas include under-the-hood improvements and fixes, as well as small changes like the ability to use an email address to put AirTags and other items into Lost Mode. Apple is also now no longer signing iOS 14.5, blocking downgrades.

Apple is being hit with a class-action suit in the U.K over App Store commissions. The group alleges Apple is behaving like a monopolist over its excessive collection of fees, and is asking for damages of around £1.5 billion ($2.1 billion).

Platforms: Google

Google announced the winners of its #AndroidDevChallenge, which showcased apps built with Android’s new UI toolkit, Jetpack Compose. In later rounds, winners received a Google Pixel 5.

Augmented Reality

Pokémon GO’s developer, Niantic Labs, is rebranding its development platform as Niantic Lightship and opening to more developers as it enters private beta. The goal of Lightship will be to allow more developers to use the company’s tech that powers apps like Pokémon GO and Harry Potter: Wizards Unite to build their own immerse, multiplayer AR games.

New game studio Sequoia Games is planning to launch a tabletop AR game to capitalize on NBA Top Shot fever. The game has elements of trading cards, NFTs and AR.

Fintech

Coinbase hit No. 1 on the U.S. App Store for the first time since 2017 on May 10. The app had broken into the top 10 in mid-April, climbing as high as No. 2 on April 14, its IPO day.

Google Pay makes its first push into the remittances market. Users in the U.S. can now send money to users in India and Singapore.

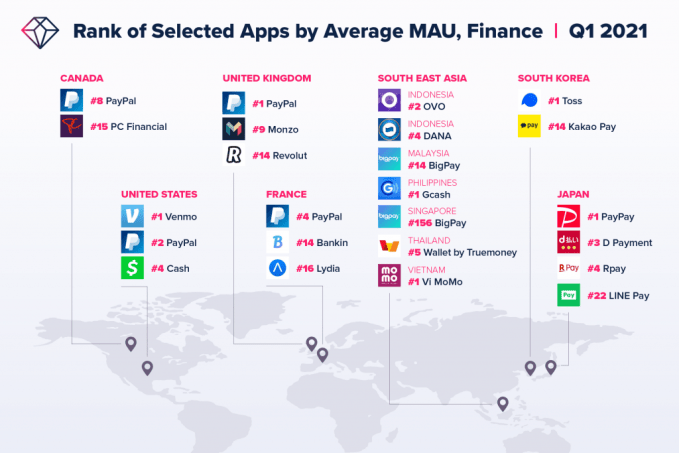

PayPal ranked No. 2 for MAUs in finance apps in Q1 2021 in the U.S., behind PayPal-owned Venmo. It was No. 1 in the U.K. and No. 4 in France. The company is preparing to make PayPal a “super app” that will enable shopping, bill pay, check cashing, investing, crypto buying and selling, and more.

Image Credits: App Annie

Social

Snap suspends anonymous Q&A apps YOLO and LMMK following a lawsuit over a teen’s death. (TW: suicide). The mother of an Oregon teen is suing Snap, YOLO and LMK after her son took his own life in 2020. The teen had received bullying messages on YOLO and LMK for months leading up to his death. The suit alleges that anonymous messaging apps facilitate bullying to such an extent that they should be considered dangerous products.

TikTok is testing a system that will allow creators to pay to promote their own videos to the For You Page, according to reports. TikTok told us the new self-serve advertising tool is not widely available, but will allow users and brands to promote their TikTok videos and foster engagement with the community more easily. The user can center their promotions around campaign objectives like video views or visits to a landing page or website.

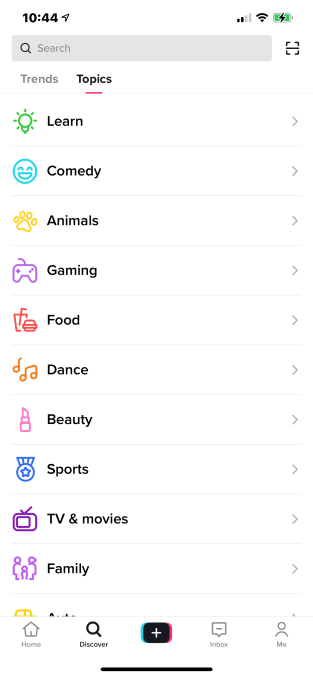

TikTok rolls out a Green Screen Duet feature and a new way to browse videos. The Green Screen Duet feature combines two of TikTok’s most popular editing tools to allow creators to use another video from TikTok as the background in their new video. The company also confirmed the test of a new way to discover videos. Called “Topics,” these are dedicated interest-based feeds featuring the top, trending videos in a given category.

Image Credits: TikTok

Facebook has begun testing its recently announced Clubhouse rival, Live Audio Rooms. The test was spotted being used by public figures in Taiwan, reported Bloomberg.

TikTok to take on LinkedIn? The video app is launching a job service that will offer a tool for brands to recruit employees. The platform isn’t integrated into the LinkedIn app, but is rather a separate web page for posting jobs and uploading video resumes.

TikTok also added a revamped Safety Center which includes a new section for parents and guardians that teaches them how to get started on the app and use its safety features, like Family Pairing. It also offers bully education and prevention resources, and details on safety and privacy tools, among other things.

Instagram is adding a dedicated spot for your pronouns in your Instagram bio. The company said it’s only available in a few countries right now, but is rolling out to others soon.

Facebook is testing new pop-up messages in its app that tell people to read a link before they share it, following the launch of a similar feature on Twitter. The goal is to encourage people to read through the article, rather than impulsively reshare potentially inflammatory content based on headlines.

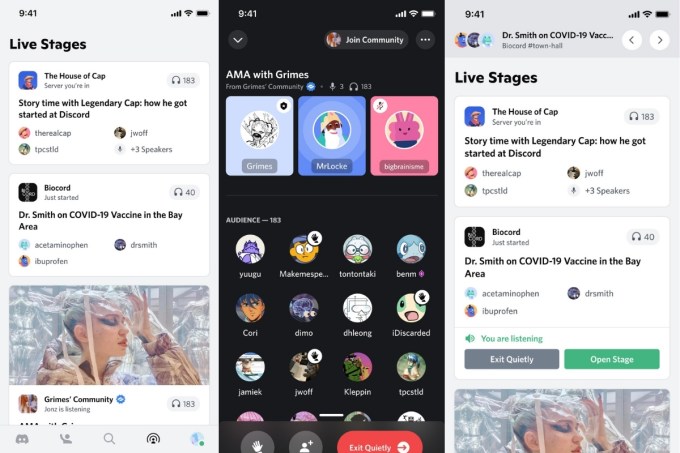

Discord’s Clubhouse competitor, Stage Channels, will begin to surface events like open mic nights, book clubs, and more through a new portal called Stage Discovery starting in June. The company is also planning to add threaded conversations and ticketed events in the future.

Image Credits: Discord

Nearly half of TikTok users are buying from the brands they see on the platform. TikTok is preparing to double down on that trend, Bloomberg reports, noting it saw a brand testing special shopping features on its profile. TikTok also told us it’s running tests in select regions, including Southeast Asia, that will pave the way for its broader expansion into e-commerce. (But you already know about these, right? Because we told you back in February!)

Messaging

WhatsApp will gradually stop you from being able to call or message your contacts if you don’t agree to its new privacy policy. After a few weeks, users will lose access to their chat lists. In a few more weeks, they won’t receive notifications and calls.

Twitter DMs will be easier to search. Nearly two years after the search feature arrived on iOS, Twitter rolled out the DM search bar to Android. It also said that later this year users will be able to search DMs for message content, too.

Signal’s beta (v5.11.0) adds a feature that allows users to share 4K images by tapping a button and selecting “High” for the image quality.

Streaming & Entertainment

Clubhouse for Android launched in the U.S. on Sunday, a year after the iOS debut. It then rolled out to the U.K., Canada, Australia and New Zealand.

Podcast streaming app Castbox was found to be streaming dozens of subscription-only shows via leaked feeds. The podcasts offer their paying subscribers private feeds to listen. But these feeds can be easily shared, then accessed by any podcast app that supports RSS.

Dating

Bumble’s shares fell sharply after its first-quarter earnings, falling below the IPO price of $43 to $38.91. Investors were spooked by Bumble’s cautious H2 guidance. Bumble reported revenue of $170.7 million in Q1 2021, up from $79.1 million in Q1 2021. Paying users increased 30% to 2.8 million.

Gaming

Roblox reported its revenue grew 140% YoY in its first earnings report since the company went public. The company reported $387 million in revenue and a loss per share of $0.46. The net loss for the quarter was $134.2 million. DAUs rose 79% YoY to 42.1 million, with users spending 9.7 billion hours on the platform, up 98% YoY.

The top five IP-based gaming titles generated $1.4 billion in the U.S. in 2020, reports Sensor Tower. The games included Pokémon GO, PUBG Mobile, Call of Duty: Mobile, Marvel Strike Force and Dragon Ball Z: Dokkan Battle. Pokémon GO led with $480 million.

Health & Fitness

Facebook shared updates on its vaccination efforts, saying more than 3.3 million people in the U.S. have used its vaccine finder since its March 11 launch. It has also given out $30 million in ad credits to governments, NGOs and other orgs to reach people with vaccine info. More than 5 million people globally have added the profile frame that shows support for vaccines, and more than 7 million people have used Instagram stickers for vaccines. Over 50% of people in the U.S. on Facebook have seen someone use the COVID-19 vaccine profile frames so far.

Uber and Lyft are giving free rides to COVID-19 vaccine sites in a deal with the White House. The free rides will last through July 4, the date when President Joe Biden wants 70% of U.S. adults to be vaccinated.

The NHS contact-tracing app had a significant impact on lowering the spread of the coronavirus in the U.K., a peer-reviewed report states. The app was “used regularly” by 16.5 million people, or roughly 28% of the U.K. population.

Apple is again seeking to dismiss an $800 million COVID app lawsuit. Apple rejected the app last year on the grounds that it didn’t come from a recognized health authority or institution.

Government & Policy

Apple’s Chief Compliance Officer Kyle Andeer responded to complaints made by Spotify, Match and Tile during the hearing held by the Senate Judiciary Committee Subcommittee on Competition Policy, Antitrust, and Consumer Rights. In a letter, Andeer reiterates Apple’s arguments, including that its commission structure is fair (e.g. it drops to 15% in year two for subscription apps; a 70/30 split is an industry standard); that the commission pays for far more than processing payments; that it doesn’t prohibit developers from communicating with customers — it only asks them to not do so inside their iOS app; and that it will provide access to UWB for Tile and others in its space, among other things.

Apple dealt some notable blows in the letter, too: it said Match had tried to implement shady pricing in Tinder that would have made an upfront six-month payment look like a subscription at one point, which is why it rejected its app update. And it refuted the idea that it used data from Tile’s retail sales inside stores to inform AirTag pricing, noting Tile “did not sell well” at Apple Stores.

Apple’s Senate Subcommittee Letter May 2021 by TechCrunch on Scribd

Facebook is ordered not to apply its controversial WhatsApp T&Cs in Germany. The Hamburg data protection agency is blocking Facebook from processing the additional WhatsApp user data it was granting itself through the T&C change.

State Attorneys General representing 44 U.S. states and territories are pressuring Facebook to walk away from its plans to launch a version of Instagram aimed at children under the age of 13, citing the potential harm to children’s privacy and development health, as well as Facebook’s track record of prioritizing growth over the well-being of users.

TikTok removed over 500,000 accounts in Italy after the country’s data protection watchdog asked the company to recheck the ages of all Italian users and block access to those under the age of 13.

Google was fined just over €100 million (~$123 million) by Italy’s antitrust watchdog for its abuse of a dominant market position related to Android Auto. Google had restricted access to the platform to electric car charging app JuicePass, made by energy company Enel X Italia.

Security & Privacy

Twitter’s new Tip Jar feature, which lets users tip others via PayPal, Venmo, Cash App and others, was quickly found to have a privacy issue. Sending PayPal payments would reveal the recipient’s home address. And even without a transaction, it would reveal a user’s email. Twitter, meanwhile, permits users to be anonymous — but PayPal would expose them.

The FTC finalized its settlement with photo app Everalbum, which misled users of its Ever app saying that it would not apply facial recognition unless users opted in. But the company did activate the feature for all users except those in three U.S. states and the E.U. It also didn’t delete users’ photos and videos when accounts were deactivated. The company must now delete the users’ content and must obtain consent before using facial recognition.

A survey from SellCell found that 73% of respondents agree with Apple’s privacy changes around App Tracking Transparency, compared with 18% who opposed it and 9% who weren’t sure. Additionally, 36% said ATT was their favorite iOS 14.5 feature.

? Apptopia raised $20 million to expand its competitive intelligence platform beyond mobile to include data coming from smartwatches, desktop and connected TVs.

? Sanlo raised $3.5 million co-led by Index Ventures and Initial Capital to help apps and games gain access to financial insights and capital. The company will ingest select data from the developer’s account related to customer acquisition costs, retention, marketing data and a subset of financial data. It will then offer insights as to when to smartly deploy capital and even offer the financing.

? Blind, a social networking app for verified, but pseudonymous employees, raised $37 million in Series C funding led by South Korean venture firm Mainstreet Investment. The app now has 5 million users and is building out its hiring platform, “Talent by Blind.”

? Snack, a “Tinder meets TikTok”-style dating app, opens up to Gen Z investors in latest round. The startup will allow Gen Z community members, influencers, creators and others to invest in the company’s upcoming $2 million SAFE, alongside other funds and angels.

? SightCall raised $42 million for its AR-based visual assistance platform for field service teams and their customers to carry out technical and mechanical maintenance or repairs. The core of its service is AR technology, which comes embedded in their apps or the service apps used by customers.

? Lili, a neobank aimed at freelancers, raised $55 million in Series B funding after seeing usage grow 1,500% in a year. The service has topped 200K users.

? Fair, a multilingual neobank, is launching to the public after raising $20 million earlier this year. The app targets people new to the U.S., have no credit or need access to interest-free loans.

? Enterprise Apple device management company Jamf acquired zero trust security startup Wandera for $400 million.

? U.K. fashion app Lyst raised $85 million in a pre-IPO round at a $700 million valuation. The company now has 150 million users, and a catalog of 8 million products from 17,000 brands and retailers.

? Vietnamese flexible pay startup Nano raised $3 million in seed funding led by returning investors Golden Gate Ventures and Venturra Discovery. Its app, VUI, now serves more than 20,000 employees from companies like GS25, LanChi Mart and Annam Gourmet.

? Korea’s Kakao buys serialized fiction app Radish as well as Tapas Media’ storytelling apps, which have more than 3 million readers, for a combined total of $950 million. The former was valued at $440 million and the latter at $510 million.

? The $600 million acquisition of reading community app Wattpad by South Korean internet giant Naver has now formally closed. Wattpad will continue to operate from Toronto, Canada, with co-founder Allen Lau remaining CEO and reporting to the CEO of Naver’s Webtoon, Jun Koo Kim.

? Astrology app Sanctuary raised $3 million in seed funding led by BITKRAFT Ventures to grow its live, on-demand astrology, tarot and psychic readings business.

GasBuddy

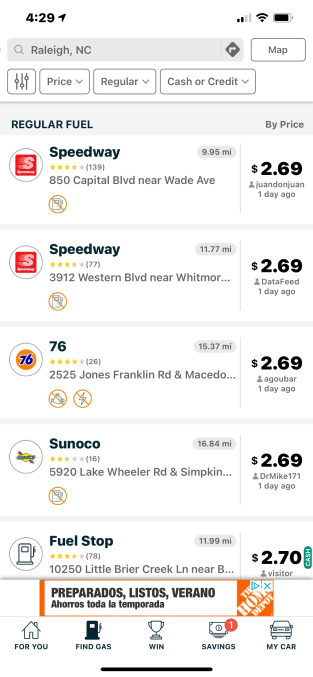

Image Credits: GasBuddy app screenshot

The GasBuddy app, which has been around for over a decade, hit the No. 1 spot on the U.S. App Store for the first time ever due the Colonial pipeline attack. The app became a must-have app for finding gas stations nearby that aren’t out of fuel or diesel, following a surge of panic-buying across over a dozen U.S. states reporting outages. The company told TechCrunch it counted 313,001 total downloads on Wednesday, to give you an idea of how many users it’s been gaining as a result of the crisis.

Waitlist this: Pok Pok Playroom

Image Credits: Snowman

Snowman, the small studio behind award-winning iOS games Alto’s Adventure, Alto’s Odyssey, Skate City and others, is spinning out a new company, Pok Pok, that will focus on educational children’s entertainment. Later this month, Pok Pok will debut its first title, Pok Pok Playroom, aimed at inspiring creative thinking through play for the preschool crowd. The app will feature a range of creative “digital toys” grounded in the real world — no unicorns or fairies or talking animals here. Rather it will feature a diverse range of characters that represent the real world as it is. The subscription-based app will have no ads or in-app purchases, so kids are encouraged to play, not pressured to buy things. The company has pre-announced its May 20th launch, but users can sign up on the website now to get an email when the app arrives.