Welcome to Startups Weekly, a fresh human-first take on this week’s startup news and trends. To get this in your inbox, subscribe here.

For longtime Startups Weekly readers, you’ll remember that edtech used to be my primary beat. Like, day one beat. Most of my coverage was focused on edtech’s rise in the early innings of the pandemic, the unicorn mad rush and even some IPOs. Duolingo continues to be the company that I know the most about, mostly because I wrote thousands of words about its savvy owl and wild founding story.

While I’m more focused on fintech these days, I was curious if edtech is still a big deal or if the sector — like most during the downturn — is facing a reset. This week, I interviewed seven leading venture capitalists who have a focus on education technology to better understand how the sector is faring during the downturn.

The big takeaway? Edtech is facing a reality check in the form of discipline. Investors explained that the whole startup ecosystem is slower this year; edtech is no different. If anything, as USV’s Rebecca Kaden put it, “The boom in the category in the last couple years means most of our education-focused portfolio is funded quite well [ … ] rounds would be opportunistic rather than out of need, and most are focused on building their businesses for the next couple years.”

As Kaden describes, it’s time to focus and edtech, luckily, has the capital to do it. It makes me think a bit about advice that my friend often gives our friend group: We’re not that special, and that’s a good thing. He means in the kindest way, and the lesson there is that feelings of change, stress or anxiety are not as deep as we may think when we first feel them. What we’re experiencing is shared by other people in their mid-20s, or, well, other sectors in startup land right now. All that matters is if you’ve invested in yourself long enough before the spotlight turns on that when the lights go down, you’re still there. Just quieter and maybe focused a bit more on backstage.

Anyway, for the full survey, read my TechCrunch+ piece: “7 investors discuss why edtech startups must go back to basics to survive.” You can also check out my accompanying analysis, “Edtech isn’t special anymore, and that’s a good thing.”

In the rest of this newsletter, we’ll get into one Haus’ closed doors, SoftBank execution fund and a pitch deck teardown you don’t want to miss. As always, you can support me by forwarding this newsletter to a friend or following me on Twitter

Bring the Haus down

I wrote about Haus, a buzzy VC-backed aperitif company going up for sale in light of a collapsed Series A. CEO and co-founder Helena Price Hambrecht spoke to TechCrunch about what went down between the company and its potential lead investor, the reasoning they got behind the fallen deal and what’s next.

Here’s what’s important: I’ve never seen an entrepreneur so transparent about the challenges, and unfortunate outcomes, that happen within startups. Here’s an excerpt from my interview with her.

“It’s always dangerous to be low on cash. We got there, and it’s unfortunate, but I know there are many companies in this position right now,” Hambrecht says. “I have been sharing my work online for over 20 years now. It’s definitely something in my DNA. If me sharing this process is helpful for another founder in a tough spot and considering their options, then it makes all of this a little more worth it.”

As for what’s next for the entrepreneur, a Silicon Valley branding veteran, there’s no immediate plans to jump into a new startup.

“My goal, right now, is to be as helpful as I can to make this ABC process have the best outcome possible. After that, I’m going to take some time to process the last four years; it’s been so extraordinary, as well as brutal and traumatic; I’m going to rest and process that.”

Image Credits: MirageC (opens in a new window) / Getty Images

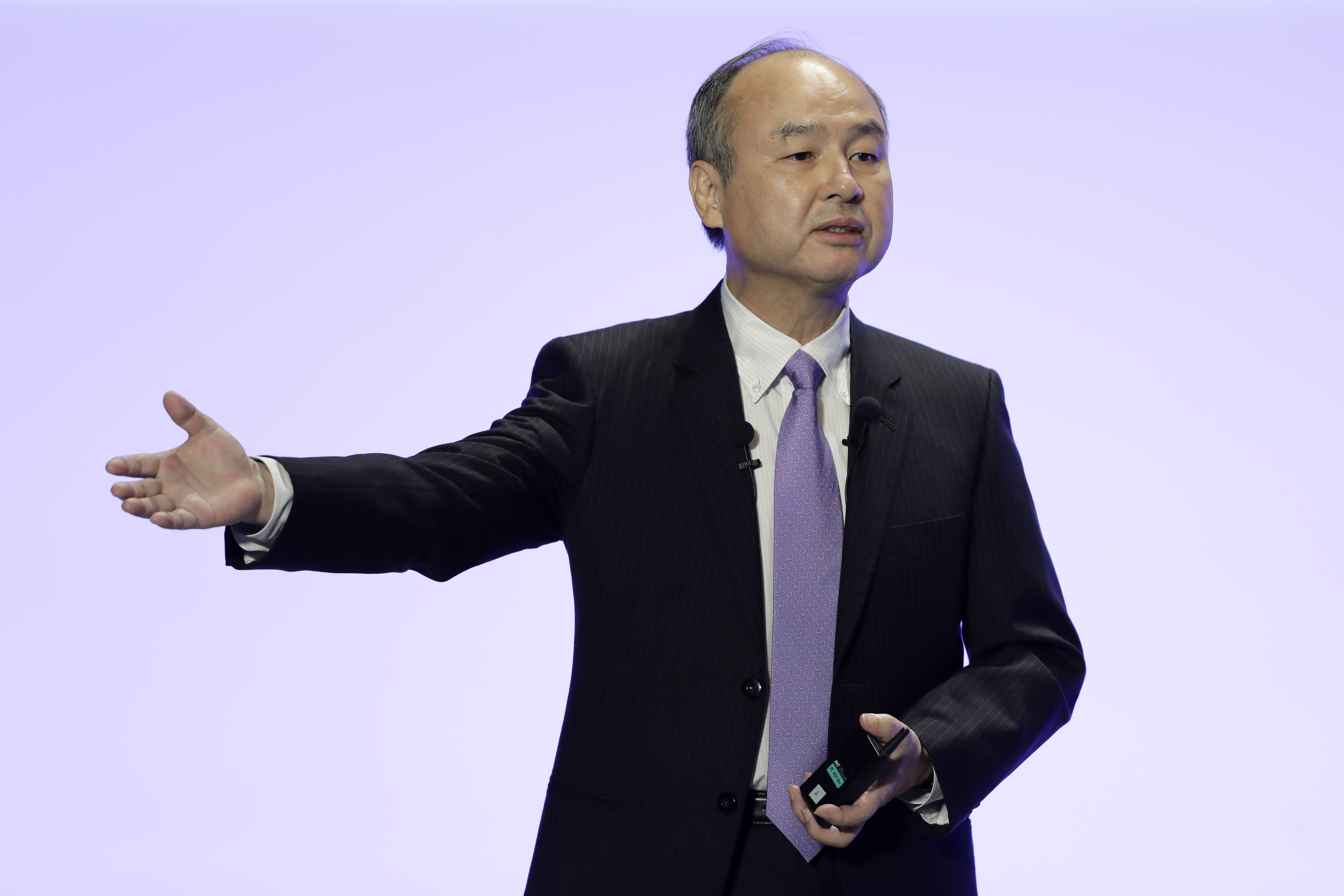

So, when is the SoftBank Execution Fund III dropping?

This week on Equity, your favorite trio dug into the numbers and nuance behind the headlines. It meant SoftBank, Coinbase and deals from ByteDance, Haus and Axios.

Here’s why it’s important: Part of the conversation hovered around SoftBank’s losses on losses, which was really the highlight of the show. Do we see a redemption arc forming for one of the biggest, buzziest investors of the past few years? And what does Tiger Global think? So many questions, and it’s always fun to get Mary Ann and Alex’s take.

Image Credits: Kiyoshi Ota / Bloomberg / Getty Images

Pitch Deck Teardown: Five Flute’s $1.2M pre-seed deck

TC’s Haje Jan Kamps is back with another pitch deck teardown, this time looking at the deck that helped Five Flute raise a $1.2 million pre-seed round.

Here’s why it’s important: If you haven’t been following along with this series, you’re — and I mean this in the kindest way — missing out. Haje goes slide by slide, and in this case, taught me a lot about why more can be more in terms of length of deck and why a “chockablock of words” is a top mistake founders make. Read the story here and pitch Haje for the series if you so dare.

Image Credits: Five Flute (opens in a new window)

If you missed last week’s newsletter

Read it here: “Venture investors to founders: Turn down for what?” We also have a companion podcast out, which you can listen to here: “Founders, whales and the sea change in the entrepreneurial energy.”

Seen on TechCrunch

Coinbase’s earnings fall short of expectations as crypto winter rages

Finix raises $30 million as fintech’s spotlight picks its sides

Mark Cuban, Mavericks in hot water over Voyager ‘Ponzi scheme’

Cloud security startup Wiz reaches $100M ARR in just 18 months

Seen on TechCrunch+

The best cloud unicorns aren’t as overvalued as you might think

Some frank advice for open source startups seeking product-market fit

How digital health startups are navigating the post-Roe legal landscape

Same time, same place, next week? Talk soon,