Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Google Play to allow support for alternative billing systems in South Korea

Following the passage of the so-called “anti-Google law” in South Korea, Google says it will comply with the new mandate by giving Android app developers on Google Play the ability to offer alternative payment systems alongside Google’s own. The legislation represents the first time a government has been able to force app stores to open up to third-party payment systems for in-app purchases — a change that could impact both app stores’ revenues, as developers look to skirt the tech giants’ commissions.

Image Credits: Google

In a blog post this week, Google says developers in South Korea will be able to add an alternative in-app billing system in addition to Google Play’s billing system for their mobile and tablet users in the country. At checkout, users will be able to choose which billing system they want to use for their purchase. Details for developers about how to implement the third-party billing systems will be provided in the weeks ahead, Google said.

The situation in South Korea is interesting as something of a bellwether for how Apple and Google will behave if required by a country to change their app store businesses to promote better competition. In Apple’s case, the company is claiming its current policies are already in compliance based on how the law is written, and has not yet made any changes to its policies related to the matter.

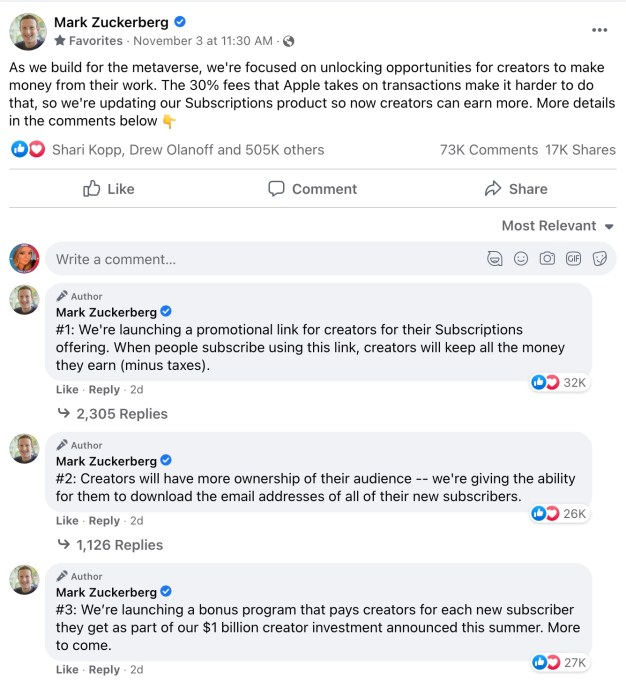

Facebook skirts Apple’s fees with creator subscriptions

Facebook is challenging Apple by avoiding App Store fees. The social network this week introduced a new feature that allows creators to share custom subscription links, giving them a way to collect direct payments from fans and make money from their work. When a fan signs up through the link, the creator keeps all the money, minus only taxes. As the links are on the web, these subscriptions aren’t being processed through Apple’s in-app payments system — which could be in possible violation of App Store policies.

But Facebook believes that these links are compliant because it’s the creators who are generating the revenue, not Facebook itself. Plus, the company isn’t removing the ability for users to sign up for a creator subscription through the native in-app payments system.

Image Credits: Facebook screenshot

This would also be in line with the recent decision in the Epic Games lawsuit, where the court ruled that Apple can’t stop developers from adding links to alternative payment systems inside their apps alongside Apple’s own. Currently, Apple is in the process of asking the court to not enforce the deadline on compliance with its decision, as the case is now under appeal by both parties.

Facebook may be correct that it’s not breaking the rules, so long as it’s not taking a cut of transactions. Clubhouse earlier this year launched a similar payments feature that allowed users to virtually tip their favorite creators. Because creators kept all the revenue (minus only the card processing fee), Apple did not intervene.

But further down the road, Facebook could find a way to capture some of that subscription revenue — either by a cut of the payment itself, or via the payment processing fees with Novi, or even both. The company’s digital wallet platform Novi has only so far launched limited support for cross-border payments between the U.S. and Guatemala (and has been criticized for failing to live up to its original crypto ambitions). But Novi’s long-term plan is to monetize by offering lower fees than credit and debit cards, compared with traditional providers. Facebook could easily get Novi in front of creators, if it chose. First, however, it has to get its foot in the door and start the payment flow without being blocked by Apple. (Facebook said it won’t collect any fees through 2023.)

Facebook and Apple have been critical of each other’s business models, with Facebook accusing Apple of using its privacy changes as cover to allow itself to carve out a place for itself in the digital advertising business where Facebook and Google lead. CEO Mark Zuckerberg made no bones about the fact that Facebook believes Apple’s commissions are bad for creators, saying: “As we build for the metaverse, we’re focused on unlocking opportunities for creators to make money from their work,” Zuckerberg wrote in a Facebook post. “The 30% fees that Apple takes on transactions make it harder to do that, so we’re updating our Subscriptions product so now creators can earn more.”

Apple rails against sideloading

Apple’s head of software engineering Craig Federighi gave a keynote address at the Web Summit 2021 conference this week where he spoke out against the idea of “sideloading” apps — meaning, simply, installing an app outside of Apple’s App Store. The speech was given in response to the EU’s draft legislation that proposes Apple open up iPhone to third-party app stores. He argued Apple’s position on the matter, which is that sideloading will put users’ privacy and security at risk and that Apple’s App Store’s vetting process will better protect users.

“Instead of creating choice, it would open up a Pandora’s box of unreviewed malware-ridden software and deny everyone the option of iPhone’s secure approach,” he said. At one point he called apps installed from the web, “a cybercriminal’s best friend,” and painted a picture of how compromised devices could become networks, and malware could threaten government systems, public utilities and enterprises.

Apple is, to some extent, correct that allowing users to download apps from the web could weaken the current state of iPhone security. But, by comparison, Google’s Android already offers sideloading — and it hasn’t so far toppled governments! — even if Android users face more malware issues than their iPhone counterparts. But one issue with Apple’s response is that it blurs the lines between third-party app stores and other forms of sideloading where users install directly from a website. Presumably, a competitive app store would be incentivized to keep its marketplace safe in order to attract and retain its own users. A random app hosted on some website is not the same thing at all.

Apple knows the real threat isn’t to security — after all, the majority of Android users don’t sideload — it’s to its reputation and business model. Customers hitting up the Epic Games Store for downloads or maybe a Facebook Game Store would cut into its revenues significantly. And every time new malware was discovered “sideloaded” onto iPhones, Apple would take a PR hit that would make its platform seem just as vulnerable as Android, losing an advantage it has today over its rival due to being more locked down.

This isn’t the first time Apple has spoken out against sideloading so publicly. CEO Tim Cook already said something similar in June. Apple also recently published a 31-page document laying out its position in detail.

Platforms: Apple

- TestFlight launched on the Mac App Store, allowing developers to now test apps that work across Apple’s platforms, not just on mobile devices.

- An Apple job posting is looking for a senior iOS engineer for Apple Music, but referenced the yet-to-be public OS name of “homeOS” as one of the platforms Apple is building for. Presumably, this refers to Apple’s HomePod, which runs a modified version of iOS, but may be getting a rebrand.

Platforms: Google

Image Credits: Google

User voting for the Google Play Best of 2021 opened globally this week. Until November 17, Google Play users will have the opportunity to vote on their favorite apps and games of the year. The winners of the Users’ Choice awards and the Best of 2021 picks from the Google Play editorial team will be announced on November 30.

E-commerce & Food Delivery

- DoorDash rolled out an in-app safety kit called SafeDash, which offers drivers in larger markets the ability to call an ADT agent if they’re in a situation where they feel unsafe, who can escalate the call to 911 if the Dasher becomes unresponsive for a period of time. It also includes an in-app 911 button. Dashers, however, argue that they want more protection, including being able to choose their delivery areas and not face penalties for choosing their safety over completing a delivery.

Fintech

Image Credits: Cash App

- Square Inc. opened up its Cash App to teens ages 13 to 17 with parental oversight. The teens can custom their own Cash card and take advantage of features like P2P payments, ATM access and paycheck direct deposit. However, in addition to spending restrictions by category, teens can’t use features like Borrow, Check Deposit, Paper Money Deposit, cross-border payments or Bitcoin or stock investing. Parents are legal owners of the account, have access to statements and can close the account at any time. The expansion may give Cash App, which has 70 million users, a better shot at passing Venmo, which is still 18 and up and has 76 million users.

- Square Inc. also reported disappointing Q3 earnings due to a drop in Bitcoin-related revenue from Cash App compared with the prior period, sending shares down. Revenue from Bitcoin rose 11% YoY to $1.81 billion, lower than the previous quarter’s total of $2.72 billion and lower than the 200% growth in Bitcoin revenue in Q2. Total revenue was up 27% YoY to $3.84 billion with EPS of 37 cents, versus analyst expectations of $4.39 billion and 38 cents.

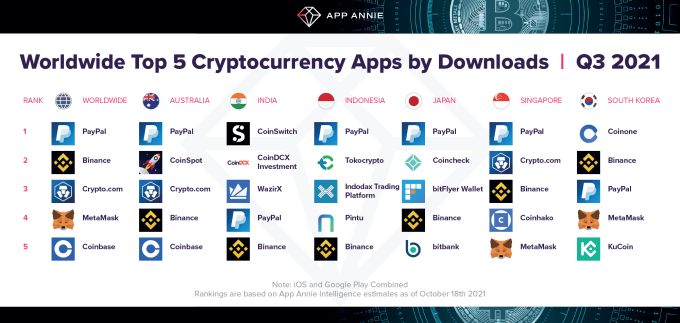

- The top five worldwide crypto apps saw a combined 46 million installs in Q3, said App Annie. These include PayPal, Biance, Crypto.com, Metamask and Coinbase.

Image Credits: App Annie

Social

- Twitter and Instagram buried the hatchet as Instagram brought back Twitter Card preview support for posts, meaning users will see a small photo when they tweet an Instagram link. Instagram had removed this support back in 2012, in retaliation for Twitter’s removal of access to its social graph.

- Twitter also this week introduced a way for users to tune into Spaces without a Twitter account, updated its API, and more.

- Pinterest reported strong profits during its Q3 earnings, with revenue of $633 million versus $630.9 million expected, adjusted EPS of 28 cents versus 23 cents expected, and ARPU of $1.41 versus $1.38 expected. However, one area where the company is not doing well is user growth. In fact, Pinterest, for the second quarter in a row, reported a decline in monthly users, 444 million versus 460 million expected, and down from the 454 million in the prior quarter. The company didn’t discuss the recent reports of a potential acquisition by PayPal.

- ByteDance founder Zhang Yiming stepped down as chairman after previously resigning as CEO, and is being replaced by new CEO Liang Rubo on the board. Shouzi Chew will also step down as CFO, as part of a larger restructuring that will establish six business units dedicated to various areas, including Douyin, TikTok, Dali Education, Lark (office collaboration), BytePlus (cloud) and Nuverse (gaming). The changes follow a crackdown on China’s tech industry, which sees the app maker moving away from content and entertainment to focus more on its work and cloud offerings. The CEO isn’t the only one to retreat this past week. Kuaishou’s CEO Su Hua did as well.

- Instagram rolled out an “Add Yours” sticker in Stories that lets users create threads that others can respond to, like “show me your #OOTD, for example. The feature is reminiscent of TikTok’s Duets feature, but more organized as users can see all the responses in one place.

- Snap partnered with NBCU to gain access to a suite of audio clips that its users can insert into their Snaps, including those sent to friends on posted to Spotlight.

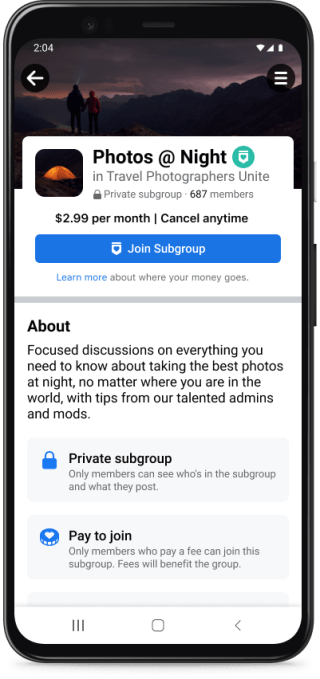

- Facebook Groups got a huge update, including new personalization features, support for subgroups and even paid subgroups, chat and other tools for generating revenue. Admins will be able to change the group’s colors, post backgrounds, fonts and emoji that members use to react to its content. They’ll also be able to use feature sets to select from preset collections of posts, formats, badges, admin tools and more. Groups can also have subgroups that can be subscription-based, and moderators can enter real-time chats to discuss the group’s content, among other changes.

Image Credits: Facebook

Photos

- The founders of the photo app Phhhoto have filed an antitrust lawsuit against Facebook, claiming the company’s execs, including Mark Zuckerberg and Instagram founder Kevin Systrom, downloaded their app and approached them about a deal that never materialized. Instead, Facebook launched a clone of Phhhoto’s features and suppressed Phhhoto’s content within Instagram, the suit alleges. The now-defunct app was founded in 2012 and allowed users to edit photos together into looping videos and became popular for a time with celebs including Beyoncé, Miley Cyrus and Katy Perry trying it out.

Messaging

- WhatsApp began beta testing a new, cloud-based version of its WhatsApp Business API, hosted on parent company Facebook’s infrastructure. With the shift to the cloud, the setup time for integrating with the API will drop from weeks to only minutes, the company claims, so businesses can more quickly transition to WhatsApp’s API platform to communicate with their customers who have opted in to receive their messages.

Dating

- Match Group detailed its plans for a dating “metaverse” and Tinder’s upcoming virtual goods-based economy during its weaker-than-expected Q3 earnings. The company’s long-term vision for Tinder and Explore, which will expand to include exclusive, shared and live experiences and a virtual goods-based economy, supported by Tinder’s new in-app currency, Tinder Coins. It also talked broadly about its larger plans for leveraging Hyperconnect, the Seoul-based social app maker it acquired for $1.73 billion earlier in 2021, which is now testing an avatar-based metaverse experience, where users interact with audio and meet in virtual spaces.

- In the meantime, Tinder is bringing back Swipe Night. It relaunches on November 7 at 6 PM as a whodunit-style murder mystery.

Streaming & Entertainment

- A new Streaming Report from Apptopia found that HBO Max was the most downloaded streaming app on U.S. mobile devices so far in 2021, with 38 million installs, and has the second-highest number of MAUs. Disney+ had 29 million installs in the first three quarters of the year, followed by Netflix with 28 million, Tubi (22.7 million) and Hulu (22.6 million).

- Spotify partnered with Peloton to launch new playlists in a “Curated by Peloton” section within the app’s “Workout Hub.” The section will feature seven rotating playlists from Peloton instructors and will offer a quiz that will help match users to an instructor who shares their musical tastes.

- Clubhouse added 13 new languages in an effort to reach more global users. The new additions include French, German, Hindi, Indonesian, Italian, Japanese, Kannada, Korean, Malayalam, Brazilian Portuguese, Spanish, Tamil and Telugu.

Gaming

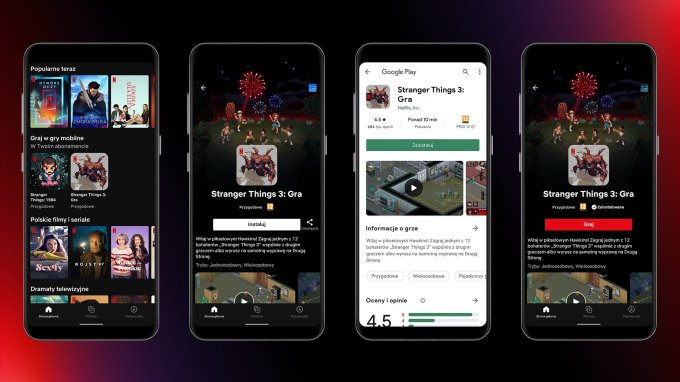

Image Credits: Netflix

- Netflix released its mobile lineup of games to all Android users worldwide. The full lineup includes two “Stranger Things” games and three casual games that were currently tested in select markets. Now, all the games will be made available from a dedicated Games tab in the mobile app which directs users to install the titles from the Play Store. Upon first launch, Netflix members will have to sign in to the games using their Netflix account info. The company’s broader plans include more mobile releases (it bought Night School Studio, for example), including those not tied to Netflix TV shows or movies, seeing gaming as just another entertainment option for users.

- Niantic’s “Harry Potter: Wizards Unite” is shutting down. The AR gaming title was meant to be the next big hit from the Pokémon Go maker, but didn’t find the same level of success, generating $39.4 million in consumer spend to date following its 2019 launch. Pokémon Go, by comparison, pulled in $1.1 billion in 2020 alone. The game will become unplayable on January 31, 2022 and is being pulled from app stores on December 6.

- In other gaming closures, Nintendo is officially discontinuing Dr. Mario World for iOS. Nintendo has shut down other mobile games in the past, including Miitomo, Pokémon Duel and Pokémon Rumble Rush, and it’s stopping updating Pokémon Shuffle Mobile and Pokémon Magikarp Jump.

- Roblox (and now, Meta) rival Rec Room says it now has over 1 million MAUs on VR, and that October 2021 delivered the company’s highest YoY user growth rate to date (up 400%). The company wouldn’t share other metrics, but it’s still a long way off from Roblox and its 43.3 million DAUs.

- Epic Games said it’s shutting down its test of Fortnite in China amid Beijing’s crackdown on the tech industry and gaming. The game will no longer be available as of November 15 and is not accepting any more users.

- Last week’s three-day Roblox outage over Halloween benefitted other popular gaming apps, according to data from Sensor Tower. The firm found Minecraft’s usage saw a 2% week-over-week boost, and Among Us jumped 6%. Among Us also saw 19% more installs from the day prior the outage. Twitch usage was also up (but that could have been from other factors, too).

- The Backbone One iPhone controller updated its companion application with new features like a smart recording mode that lets you retroactively record the last 15 seconds of gameplay, improved video quality (now 1080p 60 FPS on iOS 15), the ability to automatically switch into a “Gaming” Focus mode on iOS 15, sharing your screen directly with friends, improved game search, better load times and stability, and more. Users will also now be able to hardwire their controller to other devices like iPads, Macs, and PCs.

Image Credits: Backbone

Travel & Transportation

- Uber reported revenue up 72% YoY to $4.8 billion versus $4.4 billion expected and a loss per share of $1.28 versus 33 cents expected. The company’s Didi stake contributed to a net loss of $2.4 billion in the quarter, but Uber also reported its first-ever adjusted EBITDA profit (earnings before interest, taxes, depreciation and amortization) of $8 million up from a loss of $507 million in the prior quarter.

Health & Fitness

- Peloton, during earnings, said Apple’s privacy changes led to some “targeting headwinds” that were disrupting its business. The company joins others, like Facebook and Snap, that claimed similar issues in their latest earnings. Peloton said it would cut its annual revenue forecast by $1 billion, saying that modeling its future growth had been difficult due to COVID, and now exiting from the pandemic, the outlook needed to be updated.

Government & Policy

- Apple is fighting back against a $1.3 billion antitrust penalty in France over what regulators believed were anti-competitive agreements with two wholesalers of iPads and Macs, hurting premium resellers in the process while favoring its own stores and website. Apple also took action to force resellers to provide the same pricing as its store, among other things. Although Apple is already under regulatory scrutiny over its App Store business in global markets, it’s clear there are other areas where regulators want to hold it accountable, as well.

? South Korean mobile payments app Kakao Pay more than doubled in its IPO, popping more than 150% in early trading. The company raised 1.53 trillion won ($1.3 billion), giving it a market cap of more than 11.7 trillion won.

? Philippine fintech Mynt raised $300 million in a round co-led by Warburg Pincus and Insight Partners that values its business at over $2 billion. The company is the fintech arm of Globe Telcom and the operator of the mobile wallet app GCash, which saw GTV of over $20 billion last year.

? Mumbai-based neobank Fi raised $50 million in a round led by Facebook co-founder Eduardo Saverin’s B Capital, valuing its business at $315 million. The service offers working professional free savings accounts which are owned by Federal Bank.

? Chipper Cash, an African cross-border payments app, raised $150 million in a Series C extension round led by Sam Bankman-Fried’s cryptocurrency exchange platform FTX. The new funds come barely six months after the startup closed its first Series C round of $100 million, led by SVB Capital.

? Play, a native iOS product design tool that works on the iPhone, announced it has raised $9.1 million in seed rounds led by First Round Capital and including Oceans Ventures, which took place over the past year and in 2020.

? When I Work, a messaging and scheduling app for shift-based workers, raised $200 million in a growth round from Bain Capital Tech Opportunities, with participation from Arthur Ventures. The app is used by around 10 million hourly workers in the U.S. across some 200,000 businesses, the company claims.

Zynga’s FarmVille 3

Twelve years after the franchise debuted on Facebook, Zynga has introduced Farmville 3 on iOS, Android and Mac M1 desktops. The new imagining of the game for mobile devices evolves Farmville into more of a “metaverse,” the company claims, allowing players to not just harvest crops, but also nurture animals and participate in continuously updated new activities like hot air balloon rides or pig races, among other things.

“From the very first time I thought of FarmVille, I thought that could be the beginning of the metaverse where you could start with a square plot of dirt and build that into a persistent connected world. That was my original vision for Zynga and social gaming,” said Zynga founder Mark Pincus. The game will generate revenue through in-app purchases and ads, aiming for $100 million in annual revenue over the next five years.

Firefox Mobile (update)

Alternative mobile browser Firefox shipped its latest release for iOS and Android with an update aimed at helping users address common issues — like the visual clutter of having too many open tabs or needing to pick up where you left off the last time the app was closed, among other things. The changes are a part of the Firefox Beta, which introduced a new homepage that will now serve as a re-entry point to the mobile web, says the browser’s maker, Mozilla. The changes could make Firefox more competitive with default options on mobile devices, like Apple’s Safari or Google’s Chrome. Among the new features are a “Jump back in” section for returning to internet research, easy access to saved searches, and other recent tabs — the latter of which are archived to reduce clutter, but still accessible as needed.