Indian logistics startup Delhivery seeks to raise about $998 million in its initial public offering, the startup said in a fling with the local regulator, joining a number of other tech startups in the world’s second largest internet market to explore the public markets.

The 10-year-old startup plans to issue new shares worth $669 million, while the rest of the capital will be utilized to buy existing shares, it said in a filing (PDF).

The startup, which was valued at over $3 billion four months ago, is hoping to list at a valuation of over $6 billion in the public market, Indian newspaper Economic Times reported earlier this week.

Backed by SoftBank, Tiger Global Management, Times Internet, The Carlyle Group, Steadview Capital, and Addition, Delhivery began its life as a food delivery firm, but has since shifted to a full suite of logistics services in over 2,300 Indian cities and more than 17,500 zip codes.

The Gurgaon-headquartered firm has raised $1.37 billion in funding over the years, according to data intelligence platform Tracxn.

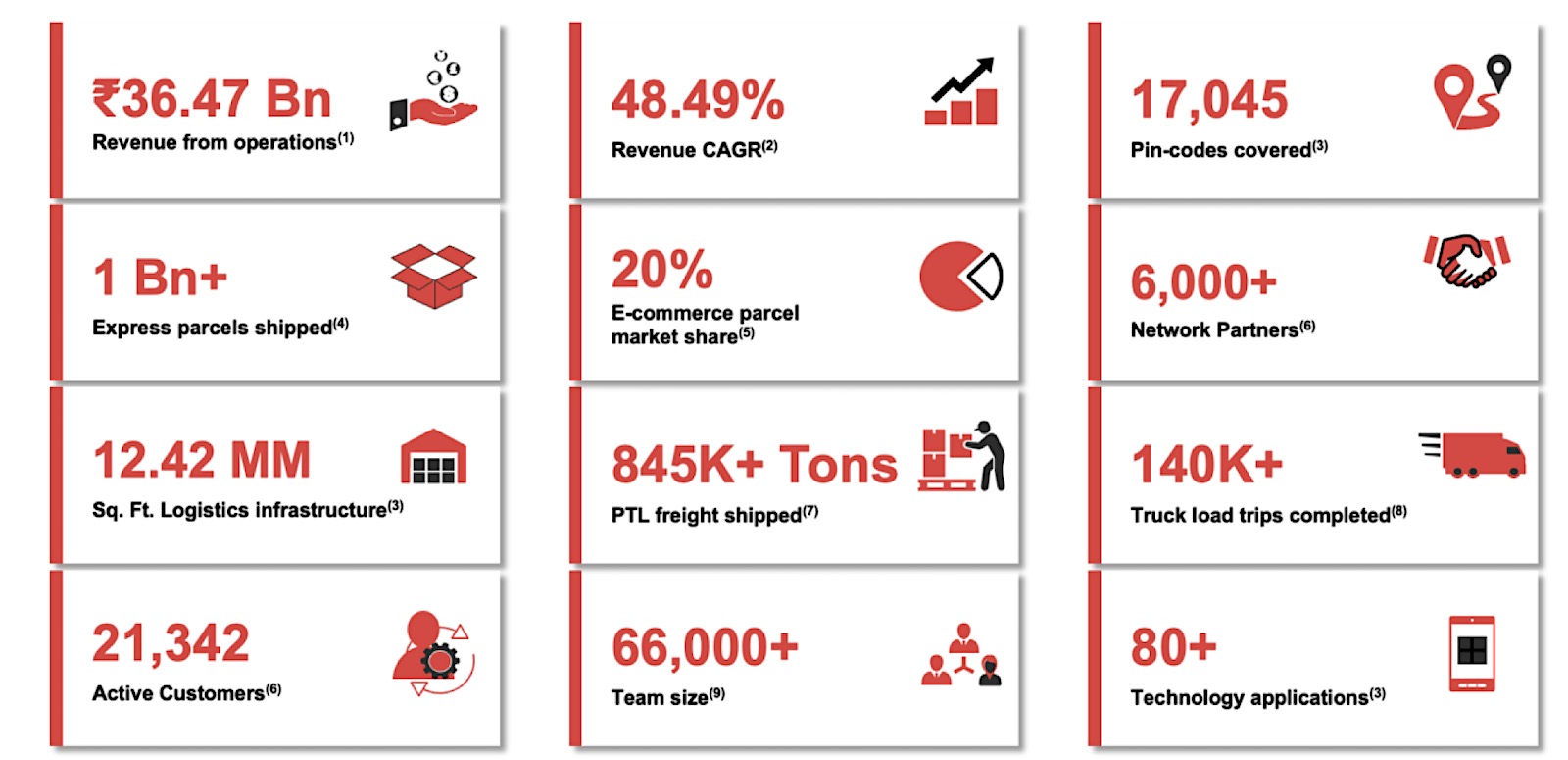

A look at Delhivery’s performance in fiscal year 2021. (Shared by Delhivery in the IPO filing.)

It is among a handful of startups attempting to digitize the demand and supply system of the logistics market through a freight exchange platform.

Its platform connects consigners, agents and truckers offering road transport solutions. The startup says the platform reduces the role of brokers, makes some of its assets such as trucking — the most popular transportation mode for Delhivery — more efficient, and ensures round the clock operations.

This digitization is crucial to address the inefficiencies in the Indian logistics industry that has long stunted the national economy. Poor planning and forecasting of supply and demand increases carrying costs, theft, damages and delays, analysts at Bernstein wrote in a report last month about India’s logistics market.

Delhivery, which says it has delivered over 1 billion orders, works with “all of India’s largest e-commerce companies and leading enterprises,” according to its website, where it also says the startup has worked with over 10,000 customers. For the last leg of the delivery, its couriers are assigned an area that never exceeds 2 square kilometers, allowing them to make several delivery runs a day to save time.

Indian logistics market’s TAM (total addressable market) is over $200 billion, Bernstein analysts wrote in a report to clients earlier this year. The startup said late last year that it was planning to invest over $40 million within two years to expand and increase its fleet size to meet the growing demand of orders as more people shop online amid the pandemic.