[ad_1]

LONDON (AP) — A digital art piece, tweaked using cryptocurrency technology to make it one-of-a-kind, sold at auction this week for nearly $70 million. That transaction made global headlines and buoyed already-mushrooming interest in these kinds of digital objects — known as non-fungible tokens, or NFTs — that have captured the attention of artists and collectors alike.

In economics jargon, a fungible token is an asset that can be exchanged on a one-for-one basis. Think of dollars or bitcoins — each one has the exact same value and can be traded freely. A non-fungible object, by contrast, has its own distinct value, like an old house or a classic car.

Cross this notion with cryptocurrency technology known as the blockchain and you get NFTs. These are effectively digital certificates of authenticity that can be attached to digital art or, well, pretty much anything else that comes in digital form — audio files, video clips, animated stickers, this article you’re reading.

NFTs confirm an item’s ownership by recording the details on a digital ledger known as a blockchain, which is public and stored on computers across the internet, making it effectively impossible to lose or destroy.

At the moment, these tokens are white-hot in the collecting world, where they’re being used to solve a problem central to digital collectibles: how to claim ownership of something that can be easily and endlessly duplicated.

I STILL DON’T GET IT. CAN’T ANYONE JUST COPY DIGITAL STUFF OFF THE INTERNET?

Sure, anyone can download a copy of Beeple’s art from his social media feed, print it out, and hang it on the wall. Just like you can take a photo of the Mona Lisa in the Louvre or buy a print from the museum gift shop. But that doesn’t mean you own those original artworks.

One purpose of NFTs is that they can be used to trace an object’s digital provenance, allowing a select few to prove ownership. In the broader picture, it’s a way to create scarcity ― albeit artificial — so that you can sell something for higher prices thanks to its scarcity.

“All the time, money and effort you spend in your digital life, you can create value for that,” said Chicago fund manager Andrew Steinwold, who started an NFT fund in 2019. “You have property rights in the physical world. Why don’t we have property rights in the digital world?”

Some NFT issuers give full copyrights to the buyer, though others do not.

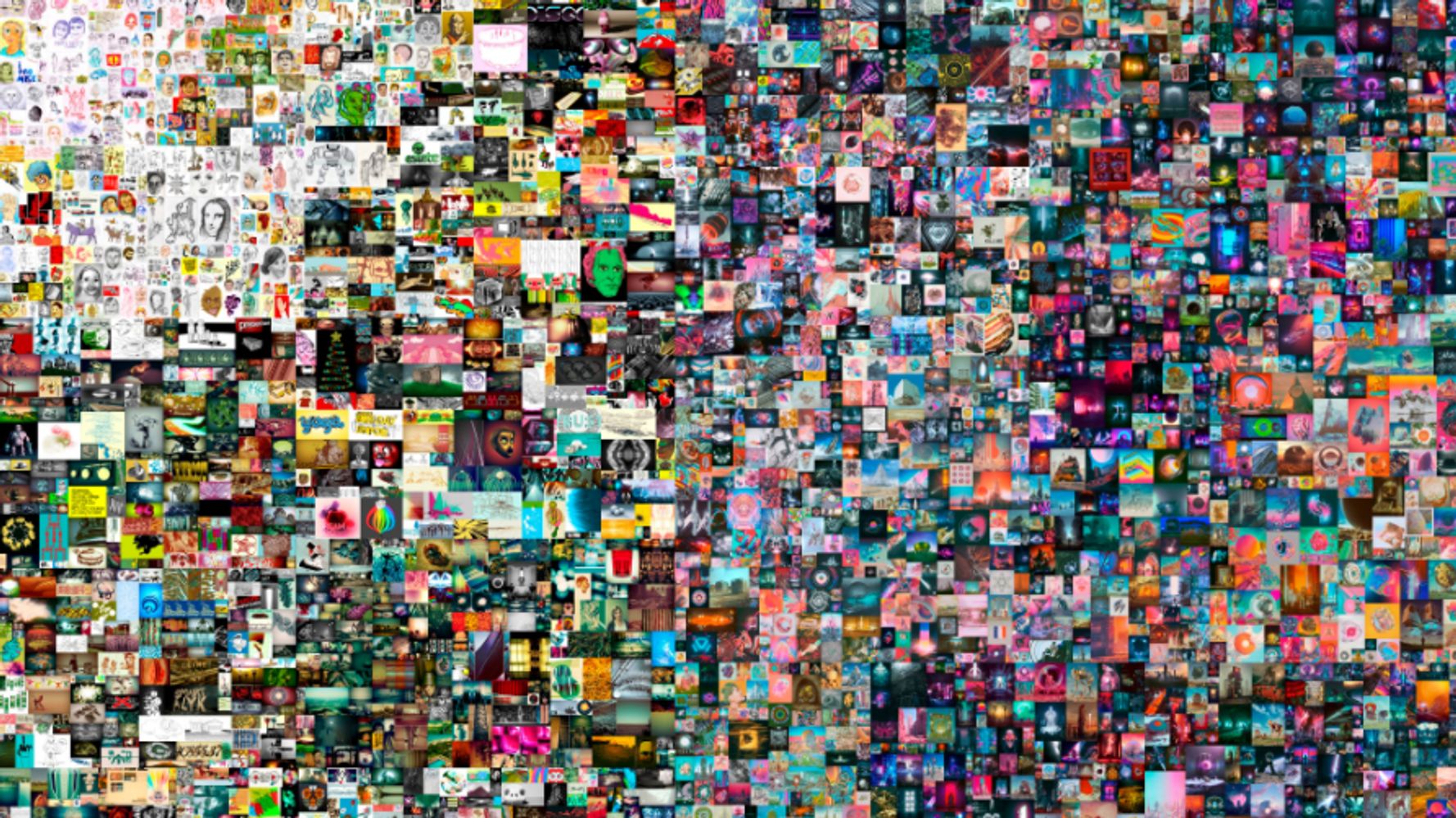

Beeple is an American digital artist based in South Carolina whose real name is Mike Winkelmann. He’s been creating digital sketches using 3D tools on a daily basis for the past 13 years. Auction house Christie’s calls his work “abstract, fantastical, grotesque or absurd.” He has 1.9 million followers on Instagram.

In December, the first extensive auction of his art brought in $3.5 million, an eye-catching amount that was surpassed by this week’s record-shattering sale of his collage “Everydays: The First 5,000 Days” for nearly $70 million, paid in a digital currency known as Ethereum.

SO WHO ELSE IS SELLING NFTs?

William Shatner of “Star Trek” fame sold 90,000 virtual trading cards last year for $1 each. Electronic musician Grimes sold $6 million worth of her digital art last month, including a video clip featuring winged cherubs floating in pastel dreamscapes that went for $389,000. Clips of NBA star LeBron James dunking are selling for as much as $225,000. Actress Lindsey Lohan sold an image of her face. You can also buy virtual land in video games and meme characters like Nyan Cat.

Digital artist Anne Spalter started out as an NFT skeptic but has now sold multiple artworks using the tokens. The latest was a video called “Dark Castles” ― of mysteriously distorted castles generated by artificial intelligence technology – that sold for $2,752.

“NFTs have opened up art to a whole bunch of people who never would have gone to a gallery in New York,” said Spalter, who pioneered digital fine arts courses at Brown University and the Rhode Island School of Design in the 1990s. “They’re investors, they’re tech entrepreneurs, they’re in that world.”

BUT WHO WOULD SPEND $70 MILLION ON ONE?

Christie’s on Friday identified the buyer of Beeple’s work as the financer of a digital art fund who goes by the pseudonym Metakovan, an announcement that could fuel concerns of a bubble in the cryptocurrency art market. The buyer founded Metapurse, described as the world’s largest NFT fund, which is likely to benefit from the heightened attention.

The British auction house said the purchase makes Beeple’s piece the third-most valuable artwork ever sold by a living artist, behind works by Jeff Koons and David Hockney.

Spalter said she expects this bubble to pop, though she still believes NFTs hold promise for artists as a way to reduce fraud and misattribution of works.

“I’m still mystified by the prices and how high they are,” she said. “I think there will be a correction.”

Calling all HuffPost superfans!

Sign up for membership to become a founding member and help shape HuffPost’s next chapter

[ad_2]

Source